Kraken Claims Trading Engine Processed Orders Correctly

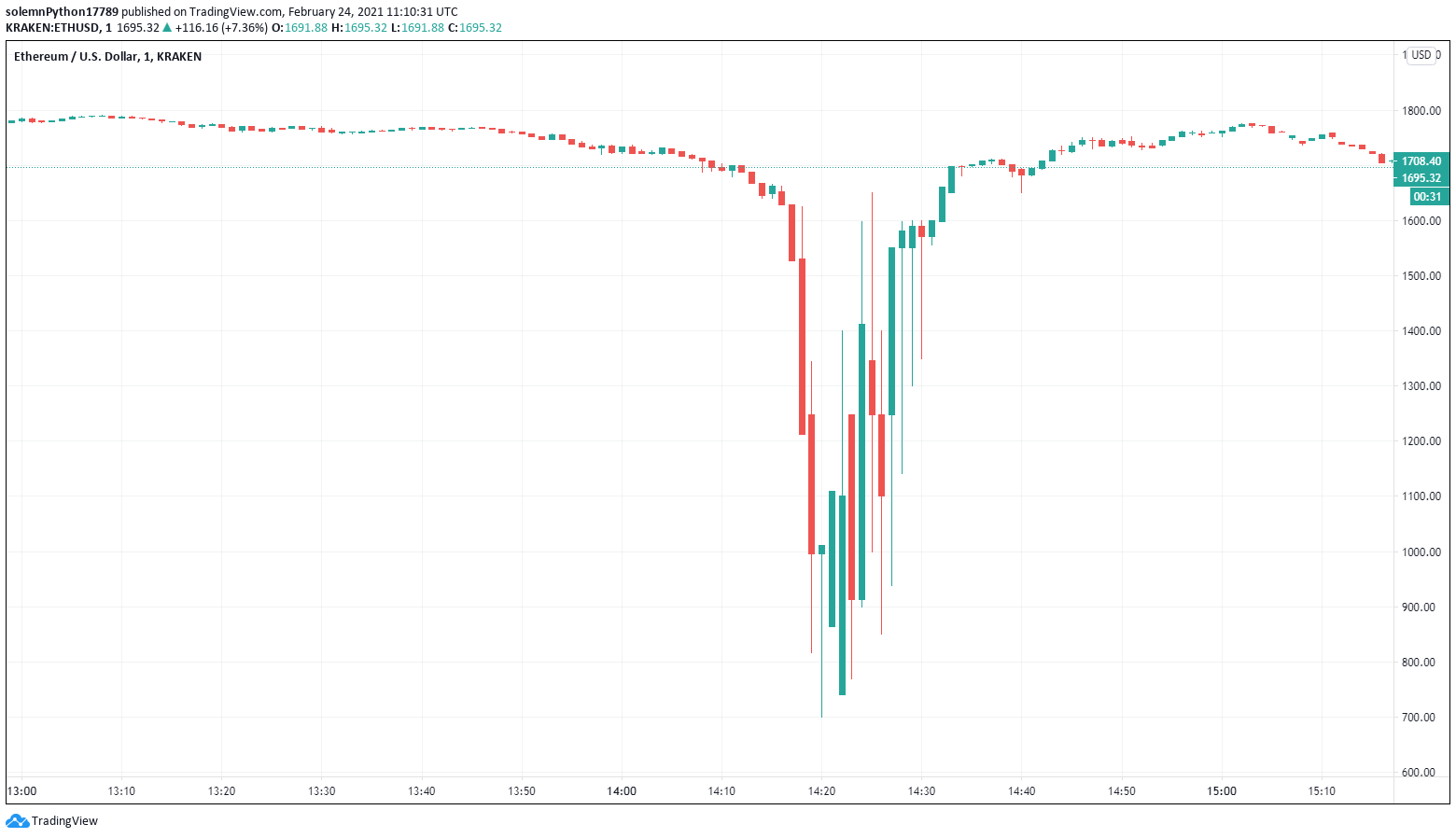

- The exchange has claimed the massive ETH selloff on Monday, which saw the price of the currency drop to $700, was not an error.

- Kraken’s CEO went as far as to say the crash could have been caused by a single big investor who decided to “dump his life savings”.

Shutterstock

The massive crash of Ethereum on Kraken, which saw the digital asset drop in price to around $700, was not caused by a glitch in the system, the cryptocurrency exchange said in a blog post on 23 February.

On Monday the cryptocurrency markets experienced an extreme selloff — with Bitcoin dropping in price by around $9,500, and Ethereum by $400 — but traders on crypto exchange Kraken noticed an even larger crash. According to trading data, ETH saw its price on the exchange plummet by more than 50% for around one minute at 14:20 UTC, but was not the only one. Other assets also experienced the same massive drop in prices on Kraken, with Cardano (ADA) plummeting from $0.842 to around $0.156 around the same price.

Following the event, many Kraken users took to social media to express their dissatisfaction with exchange, with some going as far as to threaten with legal actions. Kraken, however, claims the massive selloff was not the result of an error or a glitch, and that trades were processed accurately by their engine. Kraken’s blog post reads:

“We have since performed a detailed investigation of yesterday’s events and have found the trading engine processed orders correctly. Our market prices are not set by Kraken, but rather by our clients who are the buyers and sellers.”

During an interview with Bloomberg, Kraken’s CEO, Jesse Powell, said the massive crash was likely caused by a single big investor, who decided to “dump his life savings”. He did, however, acknowledge that the sudden dip in prices could have been made worse by the availability of margin trading and stop-loss orders on the exchange. Full compensation for the traders that incurred losses because of the dip are also unlikely, with Kraken saying:

“In digital asset markets, it’s highly uncommon to reverse trades. This is because of the importance placed on the integrity of the matching process and finality of trading.”

The exchange did say it was looking into ways to improve its “client experience”, and is currently working on incorporating the “CF Benchmarks indices as real-time index pricing for risk calculations”.

- Shortly after filing for bankruptcy on Friday, FTX experienced a hack that saw close to $500 million in tokens leaving the exchange.

- The Bahamas Securities Commission and the Financial Crimes Investigation Branch of the police have launched an investigation into the exchange to check if any criminal misconduct took place in FTX.

- The Treasury Department’s Office of Foreign Assets Control (OFAC) is reportedly investigating Kraken for possible violations of U.S. sanctions.

- Unnamed sources have said the investigation began in 2019, and that the government agency was close to imposing a fine on the exchange.

- Binance and Kraken have both said they will not freeze the accounts of “innocent users”, unless there is a “legal requirement” to do so.

- Many crypto-related platforms have started actively working to support Ukraine, and will either make donations or provide emergency relief through crypto crowdfunding.