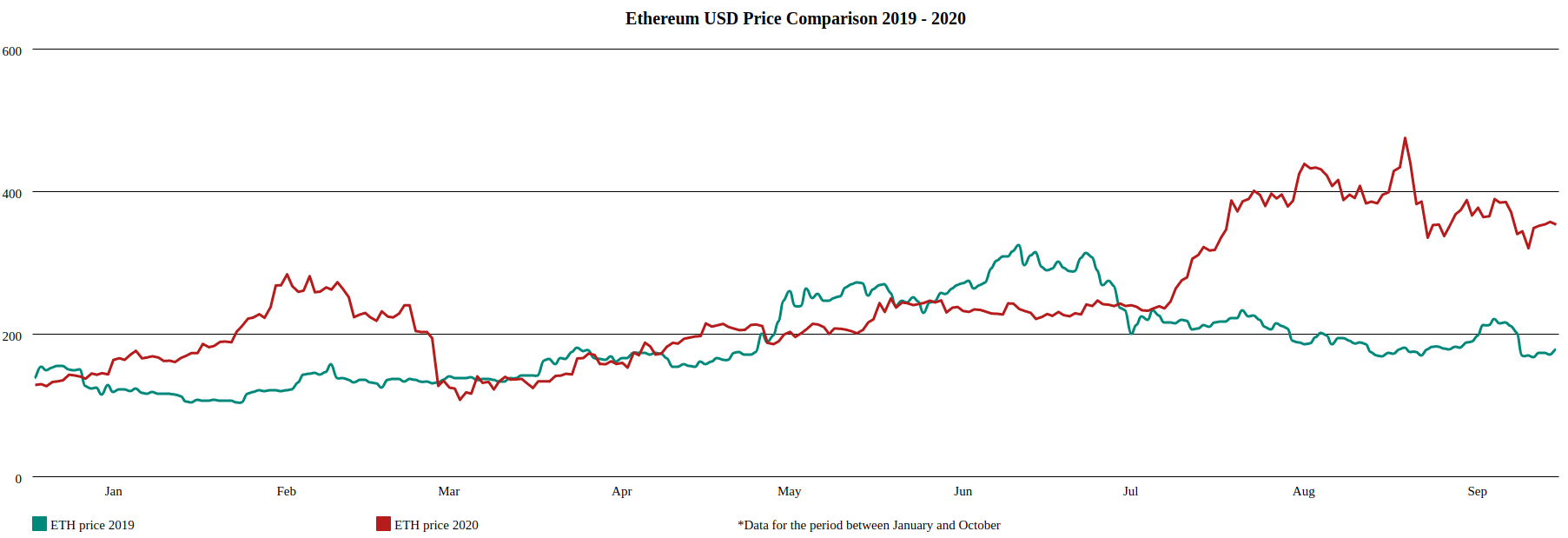

Ethereum 2019 Vs Ethereum 2020

- Ethereum was down 7.5% in 2019 overall due to version 2.0 delays, the trail of the bear market, and heavy criticism.

- In 2020, the story is different, with ETH already up 200% and the DeFi hype train at full speed.

Comparison of ETH 2019 price with ETH 2020 price for the period between January and October. Data by CoinDesk’s Ethereum Price Index

Ethereum in 2019 was stagnant. The downfall of the ICO hype, delays in Ethereum 2.0, and heavy criticism from other projects led to an ETH downtrend. While many of the top crypto assets made good recovery in 2019, Ethereum was at a loss at the end of the year – down 7.5% compared to the beginning.

On the other hand, Bitcoin recovered substantially (+90.7%), followed by Bitcoin Cash (+29.9%), Litecoin (+36.1%), and Binance Coin (+127.8%), among others. Market cap might not be everything and is not always representative of a project’s potential and current condition, but it is a very important indicator.

2019 came and went. We entered the the last year of the decade. You wouldn’t make a mistake describing this year as the year of Ethereum. The crypto asset truly returned, center stage, riding on the success of DeFi and its scalability promises.

Though 2019 and 2020 started off quite similar for ETH, that is where the similarities ended. In the summer of 2019, Ethereum tried to rebound and it somewhat did, but, as we said, delays in Ethereum 2.0 and the DeFi hype train not yet at full speed stopped the recovery. In 2020, the story was different. It is different. Now, DeFi is a phenomenon and Ethereum 2.0 is believably looking just around the corner. And so ETH is trending up. The $400 mark seems to be a difficult one for the asset, with it breaking it only for a brief moment before quickly collapsing down to this year’s familiar $350 zone. However, there are still two and a half months left of this year and Ethereum 2.0’s Phase 0 is expected to launch before the new decade begins.

Obviously, 2020 came with a lot more action for the most popular dapp platform, with decentralized finance making a huge breakthrough. For the first time, people could earn on their crypto asset holdings, instead of them just sitting frozen in their wallets. Yield farming also came into play as crypto enthusiasts worked on new and better ways to create value.

The insane returns came back, reminiscent of the ICO craze of 2017. Margin trading, options, and the growing popularity of decentralized exchanges, all contributed to the renaissance of Ethereum. Since most of DeFi is based on smart contracts built on Ethereum, ETH made a rebound and made it fast. Announcements of version 2.0 being close to launch also fueled the recovery and made it even more substantial.

Though some might argue that all of this is 2017 all over again, this doesn’t seem to be the case. The DeFi craze is certainly expanding the new bubble, but this time, as opposed to the “golden age” of ICOs, there’s actually utility in what these projects are doing. Initial coin offerings raising $10 million in 2 minutes thanks to a website set up in 2 hours and a white paper outsourced to Fiverr heavily contrasts to decentralized finance where people are actually using the products to lend and borrow assets.

Yes, there’s a lot of, for a lack of a better term, abuse happening, with yield farmers getting leveraged out of this world to farm as much as they can on as many platforms as they can. Still, the limits of all innovation should be tested. They must be tested. And if what it takes for them to be tested is another bubble, then so be it.

Summarily, Ethereum has outperformed its 2019 performance by a distance, already up by 200% on its beginning-of-the-year price. With high hopes of Ethereum 2.0’s beacon chain introducing staking to the protocol, DeFi’s growing $10 billion total value locked, and decentralized exchanges now rivaling centralized exchanges in terms of trading volume, the stage is set.

- MetaMask Bridges was designed to aggregate multiple blockchain bridges in one place, making it easier and more secure for users to transfer their assets from one network to another.

- The new feature currently supports the Ethereum, Avalanche, BNB Chain, and Polygon blockchains, as well as the Connext, Hop, Celer cBridge, and Polygon Bridge.

- Over the weekend the Ethereum PoW network fell victim to a replay exploit, with the attacker executing the same transaction on two chains at the same time.

- The exploit was caused by a contract vulnerability in the Omni cross-chain bridge, and did not affect the ETHW network itself.

- Ethereum’s PoS upgrade, also known as the Merge, was executed at 06:44 AM UTC on 15 September, combining the existing blockchain with the parallel Beacon Chain.

- The move has reduced Ethereum’s energy consumption by more than 99%, which is equal to 0.2% of the global electricity consumption.