Top 10 Crypto Predictions For 2020 Based On 2019 Growth Pattern

- 2019 growth percentages dictate Bitcoin at $13,706, Binance Coin at $31, and Tezos at $4 towards the end of 2020.

- As FOMO kicks in again, 2020 will surely set its own pace, but there’s still a lot of things to learn from 2019.

2020 has began with an explosion in crypto market growth, with bull runs sparking left and right. But, if we take the growth pattern of the top 10 crypto assets in 2019, the picture is not that colorful, for some at least.

While 2019 was not the best year for some of the top cryptocurrencies (it did good in terms of volume though), it did have its moments with one distinguishable bull run in the middle of the year.

After that though, prices leveled off and a sidelines activity began to the end of the year. Obviously, 2020 will set its own pace, but we thought it’d be interesting to see where the top 10 crypto assets will end up if they follow their growth patterns from 2019.

2019

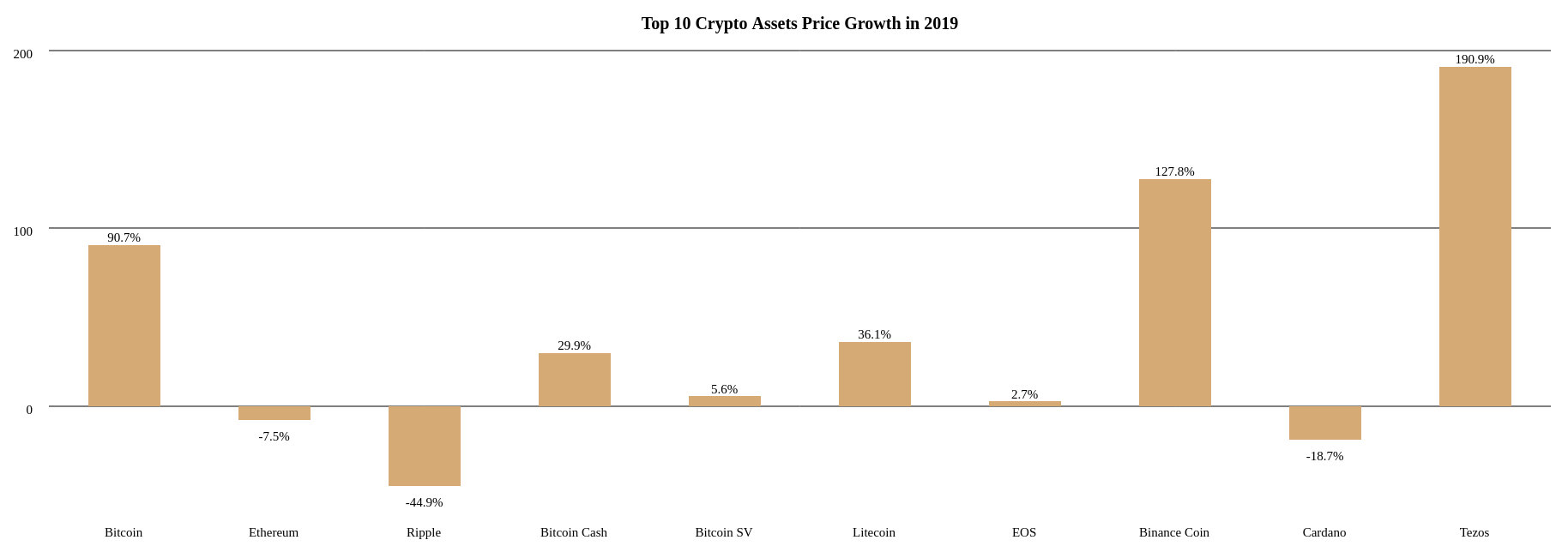

As of press time, here’s the top 10 cryptocurrencies by market cap and how they performed in 2019 in terms of price growth (comparing January 1st to December 31st prices):

- Bitcoin: 90.7%

- Ethereum: -7.5%

- Ripple: -44.9%

- Bitcoin Cash: 29.9%

- Bitcoin SV: 5.64%

- Litecoin: 36.1%

- EOS: 2.7%

- Binance Coin: 127.8%

- Cardano: -18.7%

- Tezos – 190.9%

Here’s the same data for fans of visual representation:

As you can see, half of the top 10 crypto assets performed positively in 2019, with the other half losing a portion of their evaluation. Bad news, delays in upgrades, and lack of activity were some of the causes for the drops in market caps of the below-the-line digital assets.

Positively though, BTC performed very well, followed by the uprise of Binance Coin and Tezos. Bitcoin Cash and Litecoin were steady in their growth, each ending at around 30% market cap increase.

2020

Following several bull trends in January, and one more recently at the start of February, the crypto market’s overall value has increase by more than $80 billion – a 45% jump compared to the start of the year.

However, if we have learned one thing from previous years it’s that, prices can just as easily go down as they can go up. Thus, the current bullish trend might be only a temporary fling, preceding the return of the bears. Hopefully, that won’t be the case.

In any case, here’s where the top 10 cryptocurrencies will end up in 2020 if they grow the same way they did in 2019:

- Bitcoin: $13,706

- Ethereum: $119

- Ripple: $0.1

- Bitcoin Cash: $264

- Bitcoin SV: $102

- Litecoin: $56

- EOS: $2.65

- Binance Coin: $31

- Cardano: $0.026

- Tezos: $4

$13,706 per BTC is still not even close to the asset’s all-time high, but it’s still a move in the right direction. Ethereum is highly unlikely to end 2020 at $119, considering the project’s current roadmap for 2020. Ripple and Bitcoin Cash have both been progressing well thus far in 2020, so I expect them to recover well this year.

All said, it would be nice to see the crypto assets that performed negatively in 2019 to bounce back with a positive 2020.

Summary

It is important to note again that 2020 is highly unlikely to mimic 2019 market trends. The long-awaited Ethereum 2.0 is set to go live this year, which should be able to wreck the slump in which ETH found itself in 2019. Ripple have also shared an optimistic vision for 2020, going as far to hint at a potential IPO.

Overall, the crypto market is still in its infancy and will continue to grow as more and more people join in. Although FOMO is kicking in again, it seems that prices have stabilized for now. However, the strong start of 2020 is a good indicator that the market is in an uptrend, possibly even setting up to challenge all-time highs later this year.

- Acquiring a majority stake in the GOPAX crypto exchange will allow Binance to re-enter the South Korean market, two years after it left.

- The funds for the acquisition came from Binance’s Industry Recovery Initiative, and will be used to enable customer withdrawals and interest payments on GOPAX.

- As several countries have already entered the second period of lockdown, many parts of the world are bracing for a long winter of isolation.

- How will this affect crypto markets this time around, and how will it differ from the first lockdown?

- With the forth bull run of the month, the crypto market is closing January with a strong statement.

- LTC led the way, with EOS and ETH following closely behind.