Here’s What Happened Before & After The First 2 Bitcoin Halving Events

- The two previous halving events point to a price rally 4 – 6 months after the halving happens.

- There is no clear indicator that suggests miners quit in droves after block rewards are halved.

With bitcoin’s block reward halving less than 2 weeks away (May 12), speculations about the event’s effects on the price of the most popular digital asset are not scarce. Some think this will unlock a new bull rally, perhaps this time to $100k, others think it won’t have much of an effect. And while the situation nowadays is quite different compared to the two previous halving events, there’s still so much to learn by analyzing what happened in 2012 and 2016.

In that line of thought, we took a good look back at these historic events in search of indicators that might suggest what’s to come. More precisely, we took a look at several important markers 6 months prior and 6 months after both previous halving events took place:

- The first having took place on November 28, 2012, so we looked at the period between May 28, 2012 and May 28, 2013.

- The second halving took place on July 9, 2016, thus we looked at the period between January 9, 2016, and January 9, 2017.

But before we get to what we discovered, let’s first take a look at why everyone’s talking about the upcoming bitcoin block reward halving event – is it really that big of a deal?

What is bitcoin halving

Back in 2009, when bitcoin became operational, the block reward was set at 50 BTC, meaning miners who successfully managed to solve the proof of work puzzle were rewarded 50 BTC for their efforts. Bitcoin halving events are nothing more than a halving of the block reward. In 2012, the 50 BTC reward became 25 BTC, and subsequently 12.5 BTC in 2016. In just under two weeks, it will become 6.25 BTC.

And this process will continue to happen every 210,000 blocks (roughly just under 4 years) until the 21 million BTC cap is reached somewhere around 2140. Yes, we most probably won’t be around to see that happen.

Why bitcoin halving matters so much

The bitcoin network is heavily dependent on miners in order to function properly. Miners are motivated to continue securing the network largely due to the block reward – after all they need to pay for those hefty electricity bills.

Thus, this sudden drop of 50% of the block reward could cause loss of interest in mining bitcoin, creating a volatile situation where 51% network attacks might become a possibility as large pools of miners exit the game. So, it is absolutely necessary that bitcoin mining hardware becomes more and more efficient to cope with the new economic situation imposed by halving events. After all, if mining companies calculate that they are no longer making enough profits from mining bitcoin, they will either shut down or switch to mining another cryptocurrency.

Another reason why bitcoin halving matters is because the crypto asset itself becomes more scarce once the block reward is halved. Remember, the block reward is the only way the total cap of BTC is growing, so halving that makes it so less BTC enters into circulation, which economics 101 suggests makes the asset more valuable – that is if demand remains the same.

What happened before and after the two previous halving events?

As we already mentioned, there have been 2 bitcoin block reward halving events thus far – one in 2012, and one in 2016. Naturally, we will start by analyzing what happened in 2012 by looking at the following three key metrics:

- Price

- Total network hash rate

- Mining profitability

Then we will do the same for 2016. Once we are done with both previous halving events, we will compare the findings and extract key insights that might help us predict, at least to some extent, how bitcoin will behave in the next 6 months.

The 2012 halving

Back in 2012, bitcoin and the crypto market as a whole were far from their nowadays stature. Bitcoin was still quite new to the financial scene and not many really knew what to do with it, besides using it as a highly-speculative investment instrument. Its allure mostly attracted libertarian souls who loved what bitcoin represents – a decentralized self-governed monetary system.

The price

Whatever the case was, some argue that the first halving event is what set off bitcoin and cryptocurrency on its journey to infiltrating mainstream finance. The halving of the reward forced innovation in mining, which in turn made mining more accessible as more and more people got wind of the idea of having farms of ASICs generate passive income for them 24/7. And so began one of the most prominent surges in bitcoin price, ever.

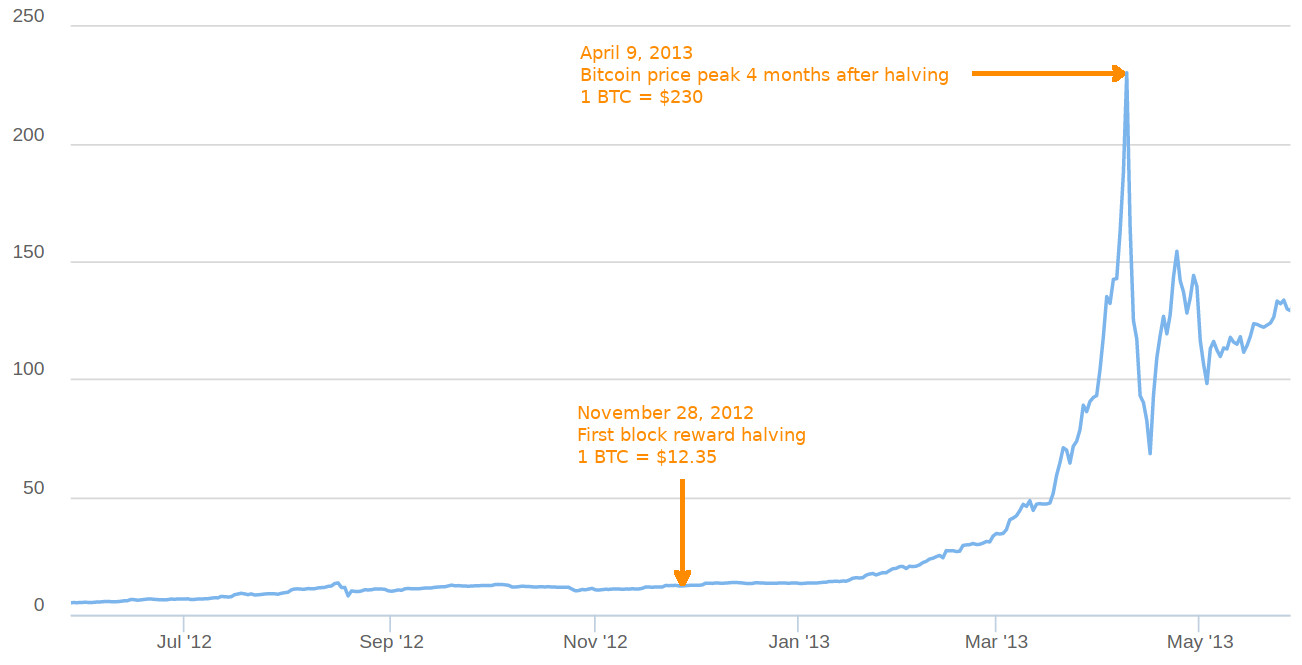

In a little over 4 months after BTC block rewards were halved, the asset’s price grew from a measly $12.35 to a staggering (at the time) $230 – close to 1,800% increase. If we take a look at the whole period surrounding the first bitcoin halving event (6 months prior and 6 months after), we can draw the following key insights:

- Lowest price was on May 30, 2012 – $5.13.

- Highest price was reached on April 9, 2013 – $230.

- BTC price jumped 2,400%, when comparing the start and end dates of the period – from $5.14 to $129.

- It took about a month and a half after the halving event for the rally to begin.

- 6 months after the halving, BTC’s price had increased by about 950% – from $12.35 to $129.

The network hash rate

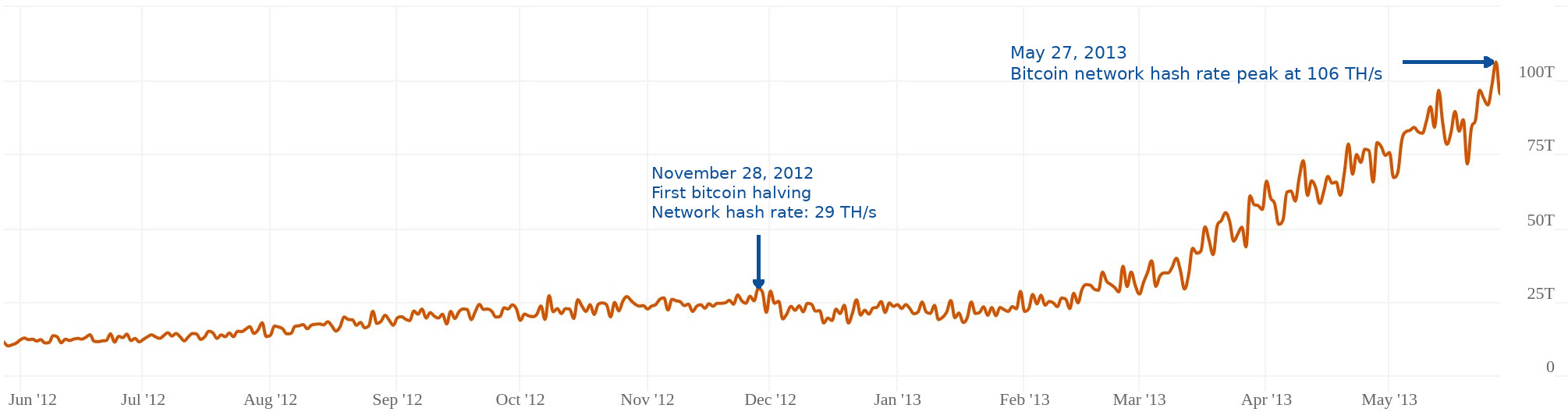

Right alongside the BTC price reaction, the network’s hash rate also responded promptly to the halving event.

As we can see from the chart above, the network hash rate dropped quite drastically in the few days following the halving, all the way down to 21 TH/s. But, it still managed to recover quite quickly. In fact, if you take a closer look at the hash rate and price charts, you can’t help but notice the similarities, especially in the uptrend forming around the beginning of January.

All in all, the bitcoin network hash rate increased by more than 700% six months after the first halving event. Compared to the beginning of the period we are examining, it had increased by more than 850% – starting at 11 TH/s on May 28, 2012.

Mining profitability

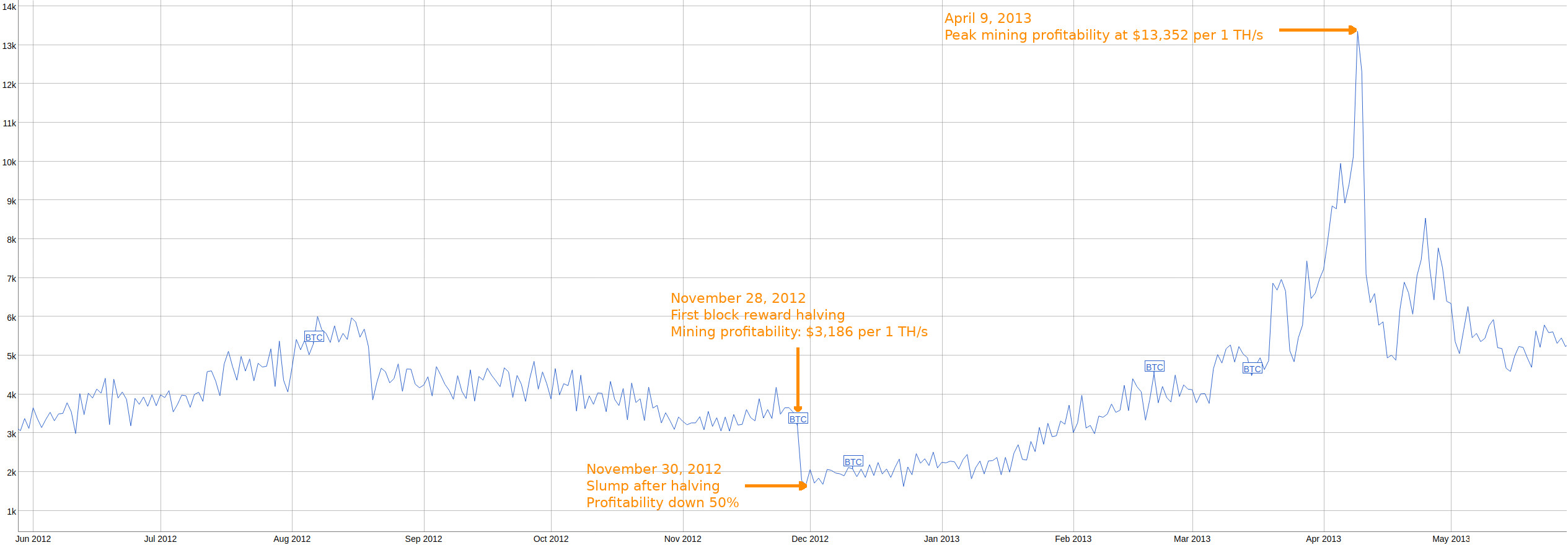

Lastly, let’s take a look at how mining profitability performed in reaction to the first bitcoin halving event.

Naturally, mining profitability reacted instantly to the halving event as is evident by the chart above. However, although talks of the end were most probably present at the time, profitability still managed to recover as innovation in ASIC technology and bitcoin price surge managed to save the situation.

Considering BTC’s price jumped by more than 2,000% in the period we are examining, a mere 50% drop in block reward didn’t stop growth much. In fact it might have actually helped, making mining more affordable and efficient by forcing businesses to find optimal ways of mining in order to cope with the new economic standards.

2012 bitcoin halving short summary

In the end, the first bitcoin block reward halving event played an important role in bitcoin’s progress towards mainstream adoption. Forcing innovation into mining technology and making BTC more scarce created a situation in which more people could more easily enter the scene and thus help promote its growth.

The 2016 halving

In the blink of an eye, almost 4 years had passed, and the bitcoin community was bracing for yet another block reward halving – the second in the history of the network. This one dropped the mining reward from 25 BTC to 12.5 BTC. As with our examination of the 2012 halving event, here we will also take a look at the price, network hash rate, and mining profitability charts, this time for the period from January 9, 2016, to January 9, 2017 since the second halving happened on July 9, 2016.

The price

While the price chart for the 2012 halving period we examined was much more streamlined, the one from 2016 has a lot more ups and downs.

Unlike the previous period leading up to the halving, this time we can clearly see that there was a rally that almost doubled the price of BTC in about a month. Perhaps the hype surrounding the second halving of the block reward played into this price volatility, seemingly forcing people to prepare for an expected price rush after the halving.

The peak this time was reach 6 and not 4 months after the halving, and “only” almost doubled BTC’s price compared to the 700+ percent following the 2012 halving event. Nevertheless, the increase in price was extremely significant as this was the first time bitcoin went over the psychological barrier of $1,000 a piece.

It didn’t last there long, but it was still quite an accomplishment as news outlets around the world now started paying serious attention to this emerging digital asset market. Fast forward a year, and BTC would be sitting at $20,000, but that’s a story for another time.

Back to our analysis, here’s a few key insights from the above price chart:

- Bitcoin price increased by 73% six months after the halving event.

- Compared to the beginning of the examined period ($448 per 1 BTC), the price jumped by 152% towards January, 2017.

- Just about 2 weeks after the halving event, the price suddenly dropped by 15%.

- After the drop, and uptrend pattern formulated, that would push BTC all the way up to $1,129.

- It took about 2 months for this uptrend to formulate.

The network hash rate

In 2016, the network hash rate steadily grew, seemingly not reacting to the halving event almost at all.

As you can see, there is a slight downtrend in network hash rate just after the halving event, but it didn’t last long. Soon thereafter, the steady growth continued all the way up to the peak for the year – 2,666 PH/s on December 11, 2016.

Mining profitability

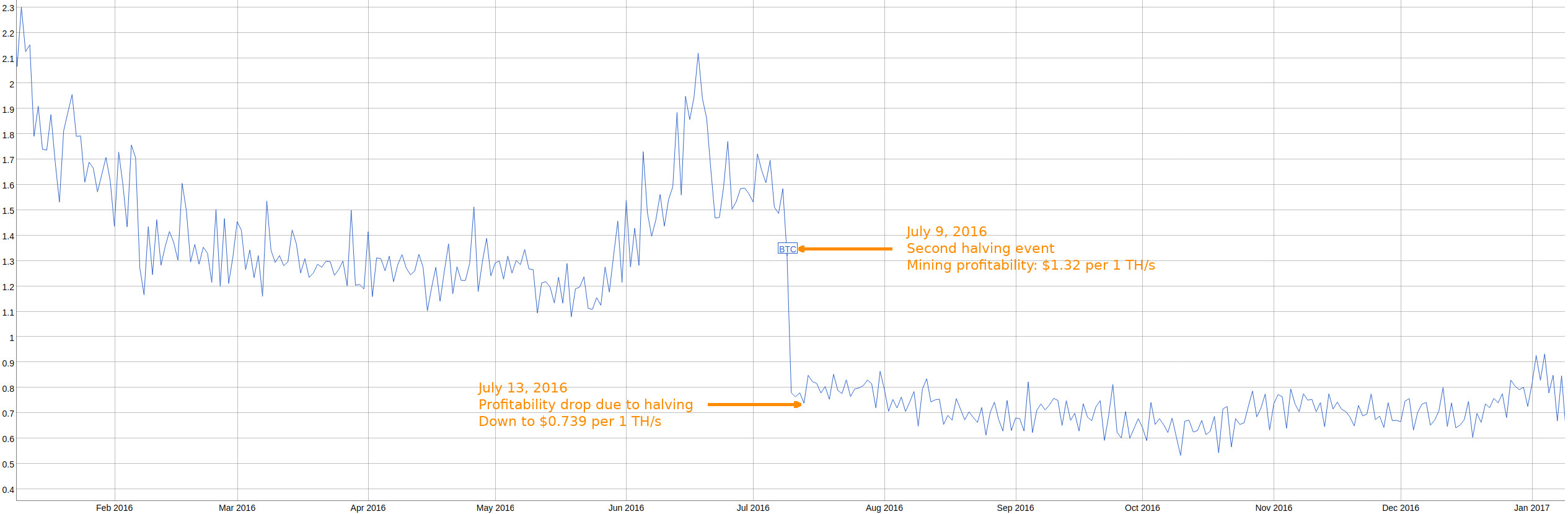

Similar to 2012, mining profitability dropped instantly after the halving took place.

Naturally, the overall dollar per TH/s had dropped quite a lot compared to 2012 as the network’s hash rate had increased multiple times over thanks to the evolution of ASIC miners. After the second halving, the mining profitability dropped to about $0.7 per 1 TH/s and danced around that number for the remainder of the year.

2016 bitcoin halving short summary

The 2016 block reward halving is considered, by many, to be the main reason the astonishing bull market of 2017 was unleashed, though looking at the charts it wouldn’t seem so. The halving surely played a part, but it doesn’t seem to have been the main ingredient. The main ingredient seems, at least to me, to have been Ethereum’s rise and the advent of ICOs. But again, that’s a story for another time.

7 key takeaways from the two previous halving events

After we took a look at the 2012 and 2016 halving events individually, we decided to examine them side-by-side and see what patterns we could identify. The below findings might be helpful in predicting, at least to some extent, what awaits us until the end of the year.

- Following both previous halving events there was a rally that peaked, respectively, 4 months and 6 months after the halving took place.

- The rallies in both the 2012 and 2016 halving events started forming about a month and a half after the halving itself.

- The network hash rate saw a slight drop right after both halving events, but recovered quickly and continued to grow steadily.

- The mining profitability dropped by 50% instantly, but that’s simple math. However, in the 2012 halving it did increase multiple times in the following months, whereas in 2016 it remained stagnant.

- In both halving event cases, right after the price peaked there was a sudden and severe drop.

- There was strong surge in price right before the 2016 halving took place – BTC climbed from $420 to close to $800 in the span of a month. There was no such activity in 2012, suggesting that people might be preparing for halving events by betting on the price going up afterwards.

- There is no indication that miners quit in large numbers after a halving event. On the contrary – in both previous cases network hash rate continued rising, probably due to innovation forced upon mining-related businesses by the halving events.

Conclusion

Bitcoin block reward halving events mark important milestones in the evolution of the digital asset. Their effects are instant only in the case of mining profitability, but in the cases of price and network hash rate, they seem to trigger a chain of events that later affect these key metrics.

With the former, a rally is unleashed a month and a half to two months after the halving. With the latter, they seem to force innovation in the mining sector, causing businesses to become more efficient in their operations.

That being said, it is not clear whether the halving events themselves trigger price rallies later on, or if the price rallies happened predominantly for other reasons. It seems that halving events and their making BTC more scarce possibly has a strong psychological effect on investors, making them purchase an asset that is supposedly going to grow in price and demand, but is now more rare.

Another scenario that our analysis supports is that the first halving in 2012 made the bitcoin network more accessible to more people, thus popularizing it and the investment opportunities it provides towards the end of the year. This popularization might have mistakenly lead people to believe that each halving will force a price rally, which could explain the premature 2016 rally and the one that followed the halving.

In both cases, it seems probable that a strong uptrend might appear a couple of months after the May 12 halving. However, it is hard to say whether Bitcoin has reached a tipping point in popularity where utility and technological adoption are the only ways it would be able to grow in valuation.

Good news is, we have failed to find any strong indicators that point to miners leaving in large numbers after halving events. However, with mining, there might also be a tipping point where block rewards plus transaction fees will no longer cover expenses. This combined with ASIC innovation hitting a brick wall (potentially) would spell really bad news for bitcoin, albeit this would only happen if BTC’s price stagnates or drops severely.

The possibilities are endless and no one can really insert a global pandemic into the equation, making the situation even more unpredictable. If history actually repeats itself, get ready for a price rally to be formulated somewhere around July, with its peak manifesting towards the end of the year. Conclusively, I guess, we will just have to wait and see what happens.

In the ever-evolving world of online entertainment, Bitcoin gaming is no longer just a niche interest for cryptocurrency enthusiasts. With the rise of blockchain technology, Bitcoin games have become a significant trend, drawing in players from all corners of the globe with the promise of transparent gaming experiences and financial incentives. As this new frontier […]

- Thanks to the emergence of cryptocurrencies and technologies such as blockchain, gambling enthusiasts now have access to a new breed of games: provably fair crypto games.

- Such games leverage blockchain technology and use encryption standards to reassure users that their chances of winning are accurately determined without outside influence.

- While not the largest countries in the world, CAR and El Salvador’s decision to legalise Bitcoin will surely have an effect on the rest of the world.

- With the rise of Bitcoin, more and more crypto-based platforms will increase their popularity and improve the industry’s potential.