3 Uniswap Pools With Over 1,000% APR

- Liquidity providers on Uniswap V3 are farming high returns for the UFO, OHM, and CRO assets.

- All three pools have more than 10 times 7d trading volume than their TVL, which is the reason for the extremely high APR.

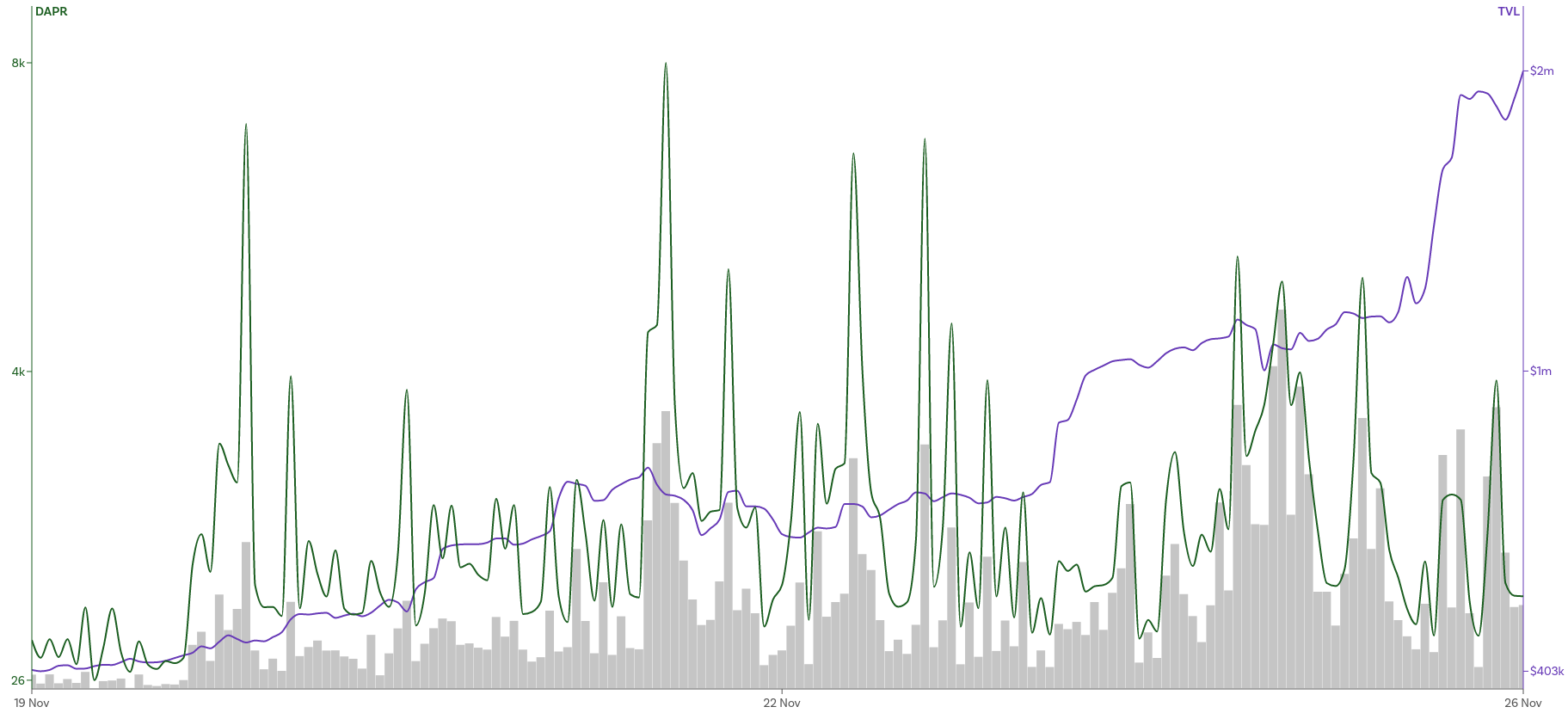

7 days TVL, DAPR, and trading volume data for the UFO-WETH Uniswap V3 pool with 1% fee. Data by The Chain Bulletin’s DeFi Watch

Back in May this year Uniswap Labs launched the third version of their decentralized exchange. Since then it has amassed close to $4 billion in total value locked (TVL) and has generated tens of billions worth of trading volume. However, despite the groundbreaking concept introduced by V3 — namely concentrated liquidity — the version has somewhat lagged compared to its predecessor. Uniswap V2 still has more total value locked (over $6 billion) and way more trading pairs.

I would argue the reason for this relatively slow growth is the difficulty in understanding the power of concentrated liquidity; we’ll go down that rabbit hole another time. But because Uniswap V3 is still gaining traction, the return rates on some of the pools there are off the charts. Here’s 3 you should know about.

1. UFO-WETH

UFO, or The Truth as the asset is titled, is the “utility token of the Dark Metaverse”, UFO Gaming states on their GitBook. The company plans on releasing blockchain-based games where each game “will represent its own planet”. The first game/planet has already been released and is called “Super Galactic”, which is marketed as an Ethereum-based “unique NFT collection and an auto battler”.

The UFO token is up 130% in the past seven days and is generating high returns for liquidity providers to the UFO-ETH Uniswap V3 pool with 1% trading fee.

In these past 7 days, the total value locked in the pool has increased from $400,000 to close to $2 million. The average Deposit Annual Percentage Rate (DAPR) for this period is 1,850%, albeit the impermanent loss is 6.26% due to the sharp rise in the price of UFO.

2. OHM-WETH

Olympus (OHM) is designed as a reserve currency with the goal of solving centralized currency issues. In short, OHM, as defined by the project itself, is an “an algorithmic reserve currency backed by other decentralized assets”. Basically the utility of the asset is that it can be used as the backing currency for a stablecoin. The project already sustains an entire ecosystem around OHM called the OlympusDAO, which currently holds more than $3.5 billion in OHM.

The OHM token is up 13% in the past seven days, but the returns it is generating for liquidity providers on Uniswap V3 are much higher.

The average DAPR of this pool for the past 7 days is 1,150%, with a total trading volume for the period sitting at $54.15 million and a current TVL of $3.34 million. Unlike the UFO-WETH pool though, the impermanent loss for this one is negligible.

3. CRO-WETH

Crypto.com is on of the most popular brands in the sector. The company has made a name for itself in the past couple of years through a series of high-level sports partnerships with, to name a couple, Formula 1 and the UFC. More recently the company has also partnered with Matt Damon on a global ad campaign to promote cryptocurrency. Naturally, the hype around Crypto.com is intense, which is reflected in the recent rise in the price of the Crypto.com Coin (CRO). In 7 days, CRO’s value has increased 60%, almost breaking the $1 mark.

And while the asset itself has brought huge returns to early buyers, liquidity providers to the CRO-WETH pool on Uniswap V3 are also not complaining.

The average DAPR of the pool for the past 7 days is a little over 1,000%, with the TVL rising from $1 million to close to $2 million. Impermanent loss is also not that high at 1.28%, considering the sharp rise in the price of CRO.

- Crypto.com has once again expanded its regulatory achievements with the acquisition of a major payment institution license for digital payment token services in Singapore.

- The license, for which the company received an in-principle approval last June, enables the exchange to provide a greater range of payment services in Singapore.

- After passing its governance vote, the proposal to deploy Uniswap v3 on Boba Network has been scheduled to proceed in the coming weeks.

- Boba Network claimed the decision will allow Uniswap to expand into the Asian market, and enable developers to build on and off-chain DeFi applications on top of Uniswap.

- Close to 6,500 wallets participated in the preliminary poll to deploy Uniswap v3 on BNB Chain, with 80% of UNI tokens being cast in favor of the move.

- The “temperature check” vote was initiated by Plasma Labs, which argued that the move was warranted due to BNB Chain’s large and growing user base.