3 Bancor Pools Begging For Your BNT

- The APW-BNT, ARCONA-BNT, and FARM-BNT pools offer the best BNT rates on Bancor for the past week.

- The top pool, APW-BNT, had a 238% average DAPR for the past 7 days, by far the best rate for BNT hodlers at the moment.

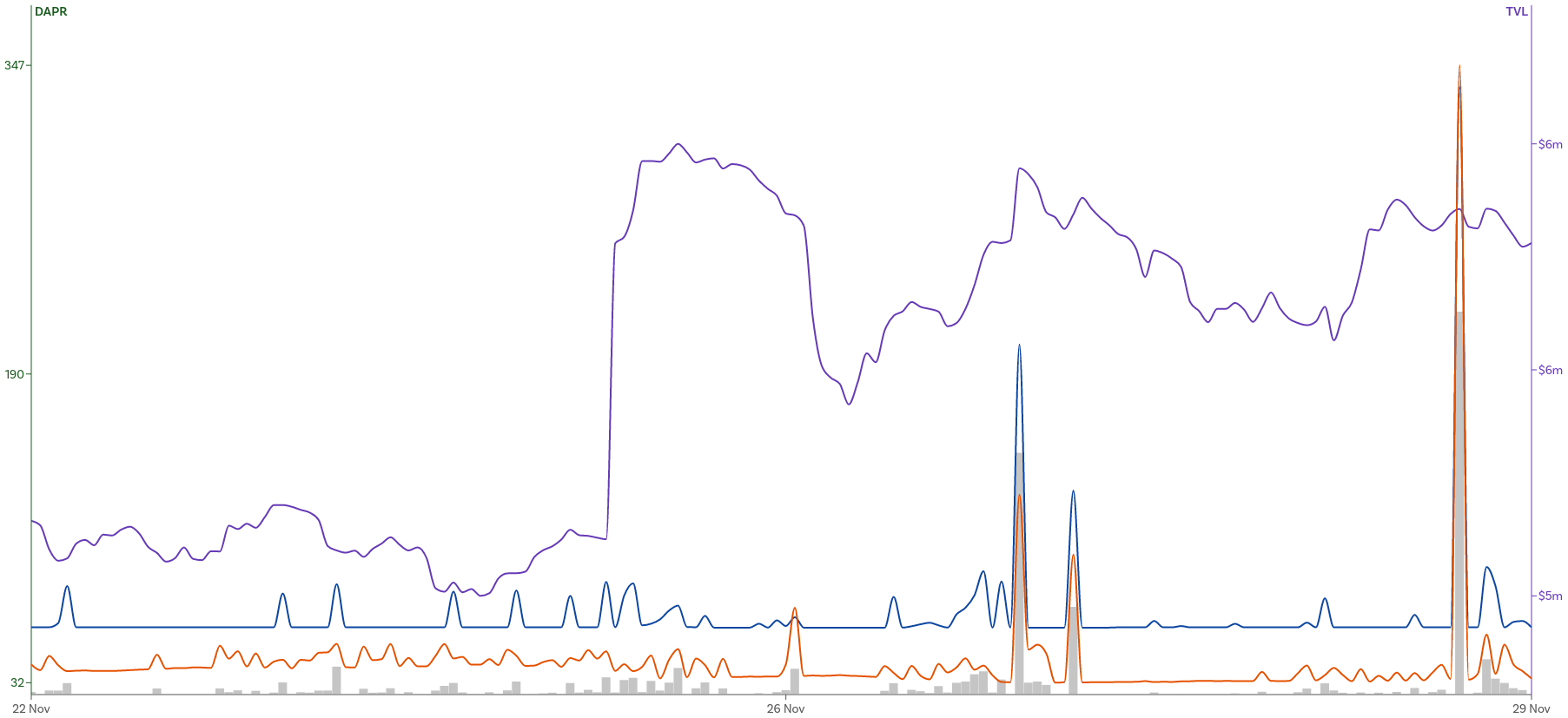

7 days TVL (purple), DAPR (blue and orange), and trading volume (grey) data for the APW-BNT Bancor pool. Data by Yield Samurai

Bancor has been a DeFi investor haven ever since their liquidity mining program began. The decentralized exchange has some of the best stablecoin rates and is the go-to place for BNT hodlers. Let’s take a closer look at the three best pools where you can stake your BNT.

How We Found The Pools

For this brief research, we used Yield Samurai and applied the following filters:

- Show only Bancor pools

- Show only pools with at least $10k total value locked (TVL)

- Order by Deposit Annual Percentage Rate (DAPR) for a period of 7 days

Here’s the result:

All of the top pools on Bancor are single-sided. If you are not aware how that works, I suggest going through this guide. Now let’s look at each of the top three pools individually.

APW (76%) – BNT (238%)

APW is an ERC20 governance token that enables APWine Finance and its DAO. Put simply, APWine allows DeFi investors to trade unrealized yield by tokenizing their stake assets as futures. For example, someone can stake DAI on Compound and receive interest-bearing cDAI; they can then stake cDAI on APWine, and sell futures tokens to people interested in sharing the interest that will be earned by the staked cDAI for a specific period into the future.

Anyway, here’s the performance of the APW-BNT pool on Bancor for the past week:

The pool currently has a little less than $1 million TVL, which is not anything impressive in the DeFi space. However, it has an average DAPR of 238% on the BNT side and 76% on the APW side for the past week. This BNT rate is by far the highest on Bancor at the moment; and the good news is that there is still space available, and impermanent loss (IL) is minimal at just 0.06%. It is important to note that most of the DAPR for both sides comes from BNT rewards, with trading volume responsible for a little over 2% on each side.

ARCONA (86%) – BNT (88%)

This pool is an interesting case mainly because the DAPR for both sides comes from trading volume. Bancor, while doing well in its own way, is not popular for massive trading volume; in the past 24 hours the DEX has facilitated a little over $50 million in trades. For comparison, the Uniswap V3 USDC-WETH pool alone has generated $750 million in trading volume for the same period.

Still, the ARCONA-BNT pool is doing exceptionally well. Arcona is an “augmented reality ecosystem” in which the ARCONA token is used to enable digital content ownership. Here’s the performance of the pool for the past week:

The pool holds close to $4 million in assets at the moment, with trading volume for the past 7 days almost reaching $1 million. The average DAPR for the past week is 88% for the BNT side and 86% for the ARCONA side, although, as you can see from the screenshot above, a large portion of the fees were collected in the middle of the period from a few spikes in trading volume.

FARM (42%) – BNT (66%)

Harvest Finance is one of the more popular DeFi aggregators. The platform’s FARM token is used as an incentive for liquidity providers, and as a governance tool. Here’s how the FARM-BNT pool on Bancor has performed in the past week:

The TVL of the pool is currently a little over $6 million, with trading volume for the past week reaching $2.6 million. The fees collected from the volume have generated about 5% DAPR for both sides of the pool, while the remaining comes from BNT rewards, 60% and 36% for BNT and FARM respectively; IL is negligible at 0.03%.

- Investment opportunities in defi are innumerous, but finding the best hasn’t been an easy task thus far.

- Yield Samurai is a decentralized finance data aggregator that helps investors find the highest-yielding pools in a few clicks.

- Yield Samurai is a decentralized finance historical data aggregator.

- It allows people to explore pool prospects on different platforms and apps to find the best place to earn interest on cryptoassets.

- Bancor 3 will offer users new pools, an upgraded impermanent loss protection mechanism, auto-compounding for staking rewards, and more.

- The upgrade is set to roll out in three phases, dubbed “Dawn, Sunrise, and Daylight”, targeting deployment for early 2022.