We Compared the Top 10 Crypto Trading Volumes From 2017, 2018, 2019 – Here’s What We Found

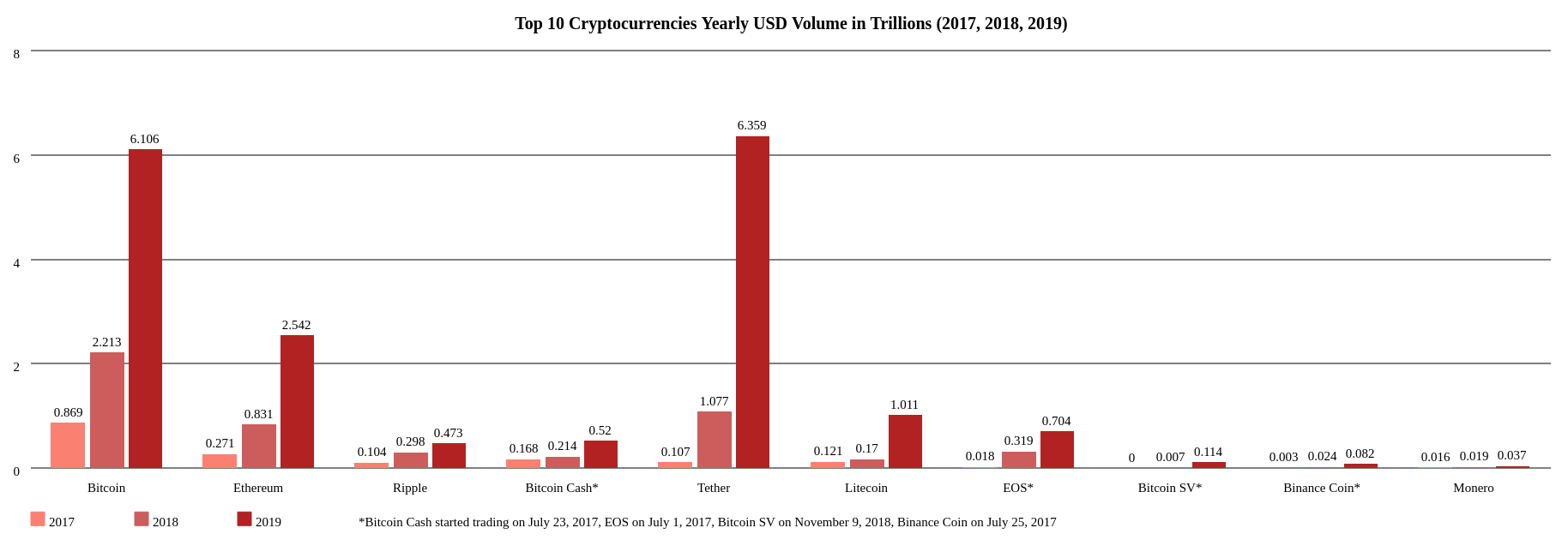

- Tether and Bitcoin led the way, with $6.359 and $6.106 trillion yearly trading volume in 2019, respectively.

- The total trading volume of the top 10 crypto assets grew by 208% and 247% in 2018 and 2019 respectively.

Trading floor of the New York Stock Exchange in New York City. Justin Guariglia/xPACIFICA/Redux

While the crypto market might have felt like it didn’t make any progress in the whole of 2019, the stats say otherwise. In this small research we analyzed the yearly USD volume for 2017, 2018, and 2019 of the top 10 cryptocurrencies by market cap – BTC, ETH, XRP, BCH, BSV, Tether, LTC, EOS, BNB, and Monero. Here’s what we discovered.

Key takeaways

- Tether had the largest volume in 2019 – $6.359 trillion. A close second was Bitcoin with $6.106 trillion.

- Bitcoin and Ethereum’s volumes steadily grew over the course of 2019, increasing respectively by 175% and 205% compared to 2018.

- EOS saw the largest increase in volume – 1,642% in 2018 compared to 2017, though trading data exists from July 1, 2017.

- Bitcoin SV was not far behind EOS’s record with its own 1,540% growth in 2019, though trading data exists from November 9, 2018.

- Tether saw the largest increase in volume compared to a full previous year – 901% in 2018 compared to 2017.

- The average yearly volume increase for the top 10 cryptocurrencies in 2019 was 355.4%.

- The same for 2018 was 380.1%.

- Litecoin was one of the best performers in 2019, topping a little over $1 trillion yearly volume compared to $170 billion in 2018 and $121 billion in 2017.

- Tether also performed very well in 2019, surpassing Bitcoin by about $200 billion in volume, compared to 2018 when it was more than $1.1 trillion in volume behind BTC’s $2.2 trillion.

- After Tether and BTC, Ethereum stood out in third place with $2.542 trillion yearly volume in 2019, a $1.7 trillion increase from 2018’s $831 billion.

- Binance Coin saw a booming 626% yearly volume increase in 2018 and 244% in 2019, topping off at $82 billion last year.

- Ripple was the only asset which did not grow faster in 2019 compared to 2018, with growth percentages respectively 58% and 186%.

- Bitcoin Cash was one of the most consistent cryptocurrencies, growing from $168 billion in 2017, to $214 billion in 2018, and $520 billion in 2019.

- Monero saw the lowest yearly volume growth in 2018 out of the top 10, with only 19%, but bounced back with 88% in 2019.

- Total top 10 crypto assets yearly volume jumped to $17.948 trillion in 2019 compared to $5.172 trillion in 2018 and $1.677 trillion in 2017.

The data

The data we used for this research was provided by CoinMarketCap. First we took the raw USD daily trading volumes and combined them to produce the yearly volumes for each of the 10 assets for 2017, 2018, and 2019:

Taking the above chart into account, we created another one, which shows how these yearly volumes grew compared to the previous year:

Though prices for some assets like Ethereum didn’t grow much in 2019, it is the overall yearly volumes that exploded, with the top 10 crypto assets reaching a total of $17.948 trillion in volume compared to $5.172 trillion in 2018 and $1.677 trillion in 2017:

This represents, respectively, a 208% volume increase in 2018 and a 247% volume increase in 2019.

What all this means

Compared to the New York Stock Exchange’s hundreds of billions traded every day, the crypto market’s total for 2019 might seem like a joke. However, in order to get to the level of the NYSE and other large stock exchanges, the crypto market will necessarily have to go through this transitional phase.

Fake volume is certainly a concern as reports have appeared of various exchanges doing wash trading to better market their services to crypto projects, tricking them into paying obscene listing fees for what effectively ends up being a week-long marketing campaign.

Nevertheless, the growth of the crypto market volume cannot be attributed only to the increase in fake volume as a result of the popularity of the crypto exchange business model. With mainstream media now covering crypto news regularly, and with the relative ease with which new investors can enter the crypto market, it is no wonder that volume has increased so much over the course of 2019.

In short, this data shows us that the crypto market has matured a lot in 2018 and 2019, slowly but surely recovering from the bubble burst in the beginning of 2018.

More key takeaways

- Bitcoin and Tether accounted for nearly 70% of the total trading volume of the top 10 crypto assets.

- Bitcoin, Ethereum, Tether, and Litecoin were the only cryptocurrencies out of the 10 that had more than $1 trillion volume in 2019.

- Binance Coin and Monero were the only two assets with less than $100 billion trading volume in 2019.

- Only Ripple and Monero couldn’t at least double their yearly volume in 2019 compared to 2018.

- Bitcoin Cash had close to 5 times more trading volume in 2019 than Bitcoin SV.

- If we rank the crypto assets by yearly trading volume from 2019, we would get the following:

- Tether

- Bitcoin

- Ethereum

- Litecoin

- EOS

- Bitcoin Cash

- Ripple

- Bitcoin SV

- Binance Coin

- Monero

- If we compare yearly volumes from 2019 to 2017, Tether leads the way with a staggering increase of 5,842%.

What the future might hold

If the trend from 2018 and 2019 holds, we might see close to 300% increase in trading volume in 2020 – around $70 trillion. Trading volume does not correlate with market cap so we cannot make any predictions there, sadly.

But back to our trading volume predictions, to be more specific:

Of course, it is highly unlikely that these numbers will be accurate as we are basing them off of the trading volume growth pattern of these assets over the past couple of years. Who knows what will happen in 2020 and how that will influence the crypto market.

Governments and central banks keep on cracking down on crypto assets with more intense regulations, and the whole Middle East crisis combined with the uncertainty of the US-China trade war, makes for an impossible-to-predict situation.

Nevertheless, the data from 2019 would strongly suggest that the crypto market is progressing towards a better future.

Conclusion

The crypto market went through swift ups and downs in 2018 and 2019, but mostly swung left and right. However, the pattern of trading volume growth is clear.

With close to $18 trillion in trading volume generated only by the top 10 cryptocurrencies, it is obvious that the digital assets market has reached a new level of maturity over the course of 2019. One could only hope that 2020 will be even better.

- SlowMist researchers have found that all tokens stolen in the $625 million Ronin bridge exploit have already been transferred to the Bitcoin network.

- The hacking group, which is believed to be North Korea-sponsored Lazarus Group, used a number of crypto mixing services and privacy tools to hide their identities.

- The Reserve Bank of Australia will collaborate with DFCRC, a $180 million research program, to explore use cases and potential benefits of CBDC in Australia.

- The research project will also feature a “limited-scale” CBDC pilot, which will operate in a ring-fenced environment.

- Uniswap can be considered the largest DEX by trading volume, having surpassed $1 billion in trading over the past 24 hours.

- Uniswap was able to onboard millions of users to the world of DeFi, lower the barrier for liquidity providers, and also introduced fair and permissionless trading.