Unibright Presents All-In-One Security Token Offering Tool Freequity

- Freequity aims to provide a 360° tokenization platform where users can smoothly run STOs.

- The tool touches bases with all key aspects of security token offerings, including regulation, integration, and liquidity.

Unibright, the company focused on building products that help businesses easily integrate blockchain into their operations, recently demoed their Freequity tool, which is marketed by the firm as a 360° tokenization platform.

For a detailed explanation of all aspects of the product, take a look at the below video where Unibright founders Marten Jung (CEO) and Stefan Schmidt (CTO) do a thorough walkthrough (with a real estate example) of Freequity:

Sifting through all the details, I have managed to grasp the key advantages of Freequity over existing security token offering (STO) tools as well as what exactly the product aims to provide to crypto users.

What is Freequity?

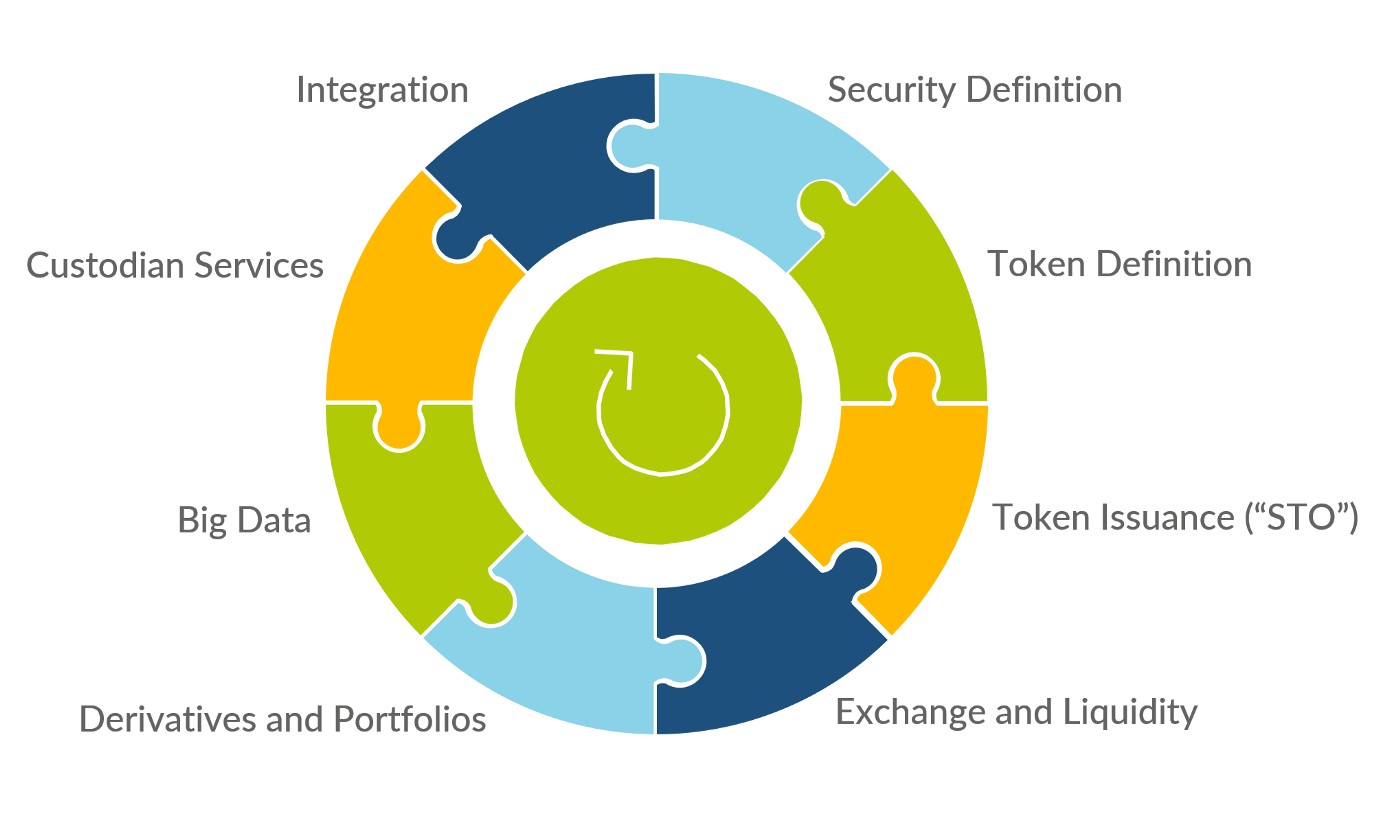

Freequity is an all-in-one STO platform, or as Unibright put it, a 360° tokenization platform, that is built around user experience. The goal of the product is to encompass the entirety of a security token offering – from the definition of the digital asset, to the generating of the technical implementation and the providing of a liquidity pool. In one image, here’s the different stages of an STO that Freequity handles:

Why Freequity

As far as I could see, the main advantages of Freequity are its user-friendly interface and the fact that it also provides an “in-house” liquidity pool. While there are other tokenization platforms, most, if not all of them only focus on handling the token sale itself. It is up to project owners to find a KYC solution, regulatory approval, and afterwards, an exchange where their crypto assets can be listed and traded.

With the exception of a few exchanges, there is little-to-no point in getting a digital assets listed. Most exchanges lack top-notch security, create a lot of fake volume, and do not know how to promote new listings well. But despite all that, listing fees are still outrageous. Essentially, a listing fee ends up being a payment for a 1-week long marketing campaign that is usually not that effective. After that, unless the project is extremely hyped, its digital assets tends to die down in trading volume (if no market making services are purchased from the exchange).

To that end, Freequity provides a liquidity pool for digital assets where they can be traded against stablecoins. A liquidity pool basically connects two digital assets, creating an environment where people can inject either one and earn on trading fees. A popular example is Uniswap, which is a liquidity pool focused on ERC20 tokens.

The other big advantage of Freequity is its user interface. Being convoluted enough, blockchain technology has been aching for user-friendly interfaces since the very start. To cover for this, Freequity facilitates the creation of projects via a step-by-step process. In the video presentation of the tool, CTO Stefan Schmidt goes through all steps, explaining what each of them covers and what information users need to provide.

Lastly, it is important to mention that, since everything is handled on the Unibright platform, or under a single regulatory roof if you will, the entire process of an STO should be much smoother.

In short, here are the eight different parts of Freequity, as defined in Unibright’s quick guide on tokenization:

- Security definition – asset owners describe what the real-world asset is.

- Token definition – a high-level graphical user interface that defines the aspects of the digital asset.

- Token issuance and STO platform – handles the token offering process.

- Exchanges and liquidity – a regulatory-compliant liquidity-backed service that guarantees trading on the same legal basis as token issuance.

- Derivatives and portfolios – a user interface that allows the creation of workflows that can automate parts of the ecosystem with smart contracts.

- Big data and AI – provides simulation capabilities for the future performance of a token.

- Custodian services – self-explanatory.

- Integration – since the whole Unibright project’s main mission is blockchain integration into business, this part cannot be overstated. In this case, integration on a technical level, process level, or market level is available.

Summary

Unibright is one of the most consistent blockchain-oriented projects in terms of development. They publish regular updates of their platform, shifting focus from one product to another. What began as a workflow diagram startup designed to work with blockchain has evolved into a full ecosystem of tools aimed at tackling key issues in the industry.

Freequity is one of those new tools. With its careful planning and smart execution, the product is looking good thus far, seemingly touching bases with all of the key aspects of security token offerings, including regulation, integration, and liquidity.

- Integrating HTS will enable Unibright users to issue tokens on a globally distributed network.

- Developers will be able to configure, mint, and manage tokens on Hedera without deploying a smart contract.

- Unibright Connector already has a “tailor made derivation” of Concircle’s workflow solution — conFLOW.

- The partnership came about thanks to the companies mutual work on Baseline-related projects throughout 2020.

- The new UBT token will be used as “integration gas” for Unibright services, calculated and managed by Provide Payments.

- Users will be able to buy the assets either directly from Provide or from exchanges and will have to transfer them to Unibright’s hot wallets in order to use their platform.