This Blog Post By Gavin Andresen Pinpoints Everything Wrong With The Crypto Market

- IOTA’s operations came to a halt back in mid-February due to a hack.

- Looking at the market cap chart, you wouldn’t ever think there was any issues.

Former lead Bitcoin developer Gavin Andresen. Web Summit

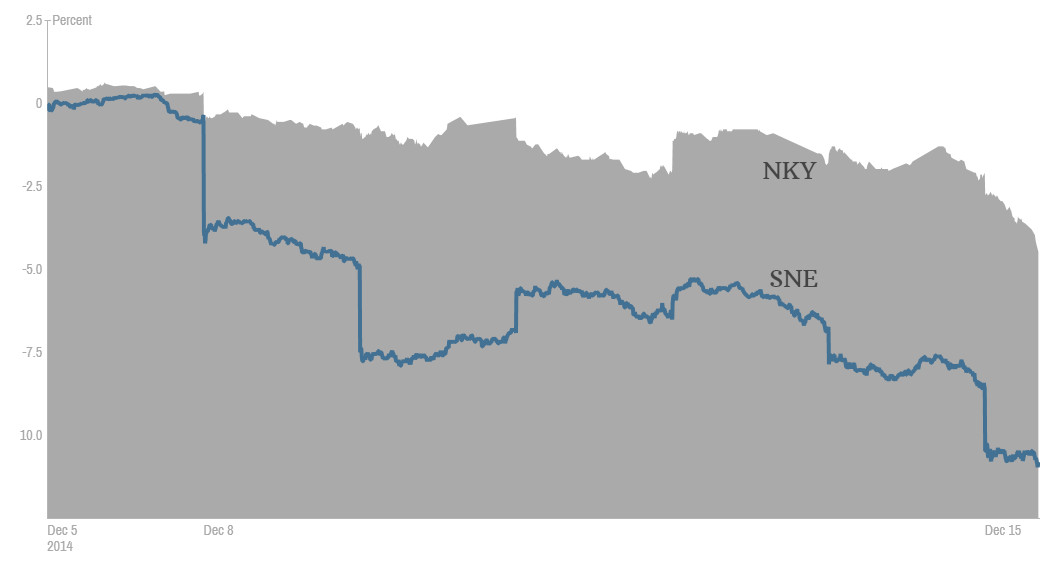

Imagine you have invested a considerable sum in Sony – the Japanese international conglomerate corporation. All is well except one day, for example, on November 24, 2014, the company announces a massive breach of internal data.

In this data are conversations of high-ranking executives and all kinds of employees that, to put it simply, don’t paint a good picture of the company’s operations. Naturally, this causes an investor scare and a subsequent dump of the stock price of Sony. Though a 10% decline might not seem like a big deal in the context of crypto markets, when it comes to large indexes like Japan’s Nikkei 225, that is breaking news.

Although the situation was very bad, there is nothing unnatural about the above chart. The company was in trouble so its stock price underperformed when compared to other companies’ in the Nikkei 225 index. Business as usual.

However, when we take a look at a similar situation involving a big company in the crypto sphere, the consequences of a large-scale hack might astonish you, as they did me.

A recent blog post by Gavin Andresen, the former lead Bitcoin developer, shows it all. Towards the end of 2019, IOTA, which is currently sitting at the number 24 spot on CoinMarketCap, suffered a major breach, now known as the ‘Trinity wallet attack incident’.

Through a vulnerability in Trinity, a wallet managed by the IOTA Foundation, a hacker managed to compromise over 50 IOTA seeds (a seed in the IOTA ecosystem is used to generate addresses). On February 11, the hacker started stealing funds from the compromised seeds. The breach resulted in a loss of around $2 million in IOTA tokens.

On February 12, the IOTA Foundation decided to shut down the coordinator. The coordinator in the IOTA network is a node that approves IOTA currency transactions. With it shut down, the entire IOTA cryptocurrency came to a halt in a bid to prevent any more funds being stolen. It took just under a month for the network to restart the coordinator on March 10, 2020.

Gavin very well put it:

“I like to think that technology matters, and better tech tends to win in the long run. I still mostly believe that, but I have to admit, seeing a cryptocurrency fail to perform its most basic function for a whole month [bold comes from original quote] and the markets shrug it off makes me wonder what people are thinking as they speculate on cryptocurrencies. Probably nobody is thinking, and it is all day traders and bots.”

Seeing as the situation was dire, any rational person would expect a large-scale dump that would mark the historic performance of IOTA for life, making it easily identifiable when compared to another digital asset for the same period. But, let’s see if you are good at mind games and can guess which one is IOTA from the following two charts:

No, it’s not the second one. The second one is Ethereum. The first one is IOTA. You’d expect that big dip to be some sort of a delayed reaction to the massive aforementioned hack, but no. That’s just a casual Ethereum dump.

In his blog post, Andresen makes a comparison between IOTA and Zcash, as the two charts look practically identical, even though Zcash didn’t experience any issues in the period between February 12 and March 10. The blog post is aptly titled “It’s not about the tech (yet?)”, ‘yet?’ obviously being the key word.

Though it’s not always the case that a major breach doesn’t noticeably affect a cryptocurrency’s market cap, that’s not the point. In a mature market this should’t happen at all, especially when basic functions such as transaction confirmation are put on hold for an extended period of time.

The good news is, things have definitely improved, albeit thanks to the bear market that followed the burst of the last bubble. But, in terms of representing real value generated by blockchain companies, the crypto market still has a long way to go.

- The number of merchants and businesses accepting digital assets is increasing steadily, and here are some examples of where digital assets can be used.

- Using crypto for payments can differ slightly from fiat systems, but getting started is not too difficult, therefore learning how to handle digital assets is essential in 2023.

- Thanks to the emergence of cryptocurrencies and technologies such as blockchain, gambling enthusiasts now have access to a new breed of games: provably fair crypto games.

- Such games leverage blockchain technology and use encryption standards to reassure users that their chances of winning are accurately determined without outside influence.

- Chrysalis has made IOTA enterprise-ready, with the protocol, wallet, and suite of libraries now fully operational.

- This is the last major upgrade before Nectar, the complete implementation of the Coordicide modules.