How to Leverage Yield Farming on Alpha Homora – The Simple Guide

- Learn how Alpha Homora works, how to open a leveraged position and earn more with the same amount of assets, and how to manage your positions.

- We also explain how to choose a pool to leverage, the rules of leveraging on the platform, and how to calculate possible scenarios.

Shutterstock

Table of Contents

Alpha Homora is one of the most popular DeFi platforms. It allows investors to leverage their liquidity mining positions on platforms such as Uniswap and SushiSwap; instead of staking $10,000 worth of assets directly on SushiSwap, you can go through Alpha Homora and open up a $25,000 position, earning a lot more in profits, not counting additional rewards you will be receiving in the form of ALPHA tokens.

What You’ll Learn

- How Alpha Homora works

- How to choose a pool to leverage

- How open a leveraged position on Alpha Homora

- How to manage your leveraged position

- How to use Alpha Homora on Binance Smart Chain

- Additional ways you can earn on Alpha Homora

How Alpha Homora Works

Alpha Homora is a hybrid DeFi platform. It offers lending features similar to Aave and Compound but also provides a distinctive liquidity mining program. Its lending feature is used by liquidity providers to open leveraged positions. In short, it works like this:

- Someone deposits ETH on Alpha Homora to earn from borrowers.

- Someone else decides to open a leveraged position on SushiSwap.

- Instead of going directly to SushiSwap, they stake through Alpha Homora, borrowing ETH from the lending pool to leverage their position by up to 2.5 times on Ethereum, and up to 3 times on Binance Smart Chain.

- The increase in APY they get from the leverage (more yield farm and more trading fees) provides enough additional rewards to cover the interest for the borrowed ETH, with the remaining profits accumulating in the position.

The entire process is seamless. You don’t need to borrow ETH, swap your assets, provide liquidity, before finally staking to earn rewards. It all happens in one transaction.

There’s two versions of Alpha Homora – V1 and V2. The latter version is a natural evolution of its predecessor, with various improvements implemented to improve security and profits. At the moment, leveraged positions cannot be created on V2 — the Alpha Homora team has yet to state when that will change.

Leveraged positions can be opened only in supported pools on supported platforms. For instance, at the time of writing, popular pools on SushiSwap and Uniswap are available.

More recently, Alpha Homora was also deployed on Binance Smart Chain (BSC), with popular pools on Pancake Swap — the Uniswap of BSC as some call it — becoming available for leverage; only Alpha Homora V1 is available on BSC. The process of opening a leveraged position on Ethereum and BSC is identical, the only difference being the main asset that is used — for Ethereum it is ETH, for BSC it is BNB. Over the course of the guide we will use examples from the Ethereum network; assume that the same is applicable to the Binance Smart Chain side of Alpha Homora (with different numbers).

How to Leverage Yield Farming on Alpha Homora

The process is simple enough, though you need to prepare a few things beforehand:

- Choose a pool to leverage

- Install and set up MetaMask

- Buy cryptocurrency

- Open a leveraged position

- Manage your position

Choosing a Pool to Leverage

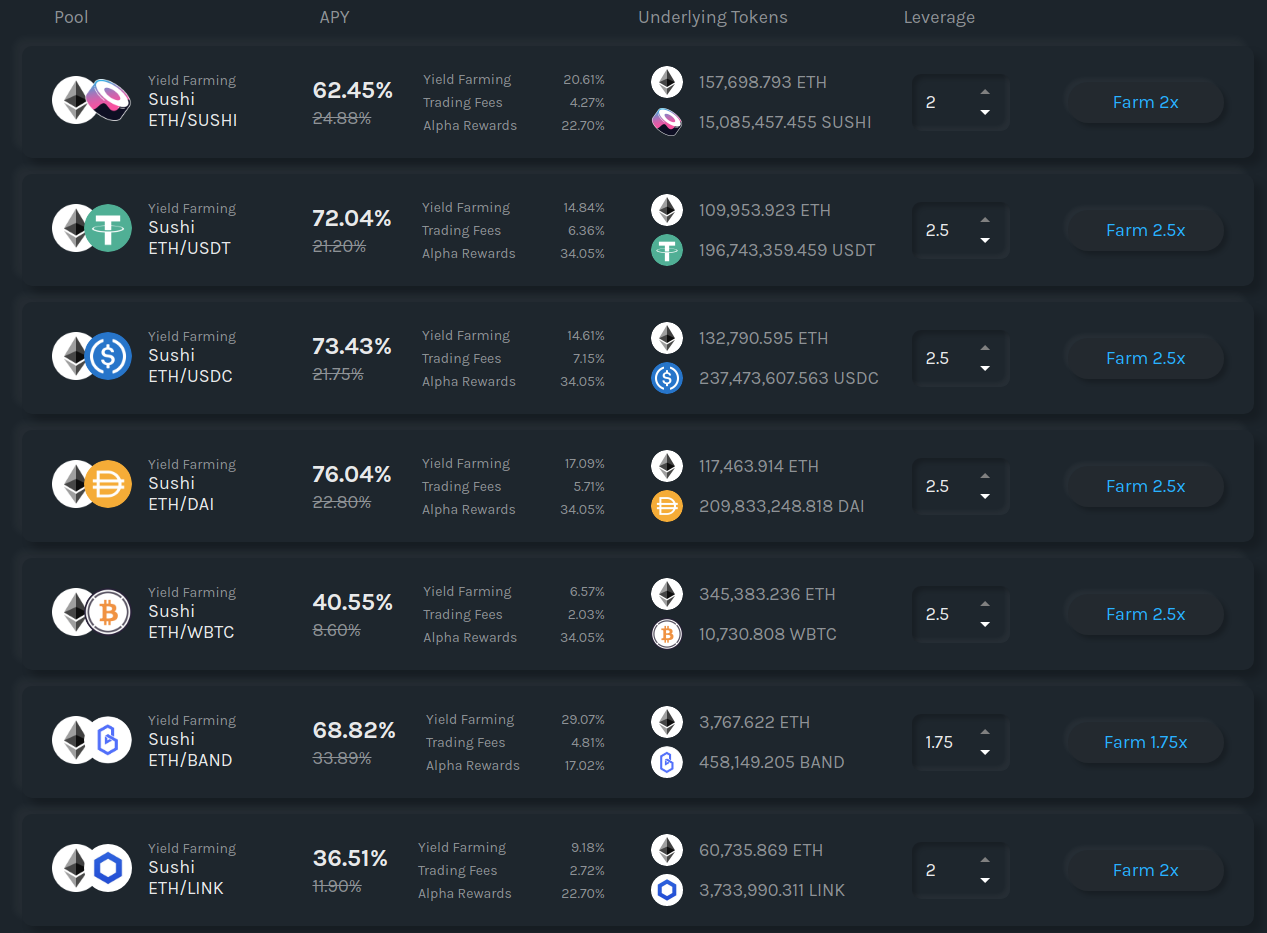

As we already said, leveraging is currently enabled only on Alpha Homora V1, which is available on both the Ethereum network and the Binance Smart Chain. Let’s see what the Ethereum network offers and let’s choose a pool to farm:

Note: the APY numbers you see around the app apply to the principal, not the total value of the leveraged position.

Now, before we can choose a pool, we need to explain the lifecycle of leveraged positions on Alpha Homora. It goes like this:

- I want to leverage the ETH/SUSHI pool on SushiSwap (max leverage of 2x).

- I have 10 ETH at my disposal (why farm with 10 when I can farm with 20?).

- I borrow 10 ETH and open my leveraged yield farming position.

- My debt ratio is 50% — 10/20 where 10 is my debt and 20 is the total ETH valuation of my position (I hold 10 ETH and 10 ETH worth of SUSHI).

- At a critical threshold, my debt becomes available for liquidation — critical thresholds (liquidation debt ratio) for all pools can be found here for the Ethereum network and here for Binance Smart Chain. For my pool it is 70%, i.e., if the ETH value of my position drops to about 14 I would either have to add more assets to the position, or it will be liquidated.

- Once my position is liquidated, I will receive whatever assets are left of my original 10 ETH after the debt is paid. In this example, since my position is 14 ETH, but my debt is still 10 ETH, I will receive back 4 ETH from my original 10.

Since your debt is in ETH, and your position is also valued in ETH, you need to make sure to pick pools intelligently, not only based on APY; the APYs of the stablecoin pools are usually the highest, however, this comes with more risk of liquidation. Here’s another example:

- I am a FOMO-susceptible noob who learned about Alpha Homora by scanning some of the whale addresses on DeBank.

- Instead of doing thorough research and understanding how the platform works, I open it up and look at the APY numbers, naturally, raging because there is no sorting feature. As I scroll my attention is caught by the 76% of the ETH/DAI pool, which also allows the maximum 2.5x leverage. Easy choice, right?

- I have 20 ETH and I open a 2.5x position (50 ETH). The liquidation debt ratio for this pool is 80%, and a 2.5x leverage puts me at 60% off the bat (30/50).

- ETH’s price at the time I open my position is $1,800.

- In a week, ETH’s price has doubled. The ETH value of my debt is the same — 30 ETH — but the ETH value of my position has dropped significantly because I am a participant in an AMM-based pool, and one side of the pool is a stablecoin.

- My leveraged position reaches the liquidation threshold of 80% and a liquidator puts an end to it.

The 2 Rules of Leveraging on Alpha Homora

- A leveraged position in a stablecoin pool retains its USD value, but its asset value is very volatile. For example, if you have a 10 ETH position in the DAI/ETH pool on SushiSwap, and ETH moves a lot in USD price (up or down), the USD valuation of your position will remain stable, slowly accruing gains from trading fees and SUSHI rewards. However, the ETH value of your position will fluctuate a lot because 50% of your position is in DAI, which is always $1; if ETH’s price moves up, the ETH valuation of your position will go down and vice versa. If the price of ETH jumps high enough your position might get close to the liquidation debt ratio. That’s why it’s never a good idea to leverage stablecoin pools to the max. In short, positions in stablecoin pools are good if you want a stability in terms of USD value, and if you are not too worried about ETH mooning unexpectedly.

- Conversely, a leveraged position in a pool with two volatile assets — for instance, ETH/LINK on SushiSwap — has a very volatile USD value, but a stable asset value (if the two assets resemble one another in movement). For example, if you have 10 ETH in the ETH/LINK pool on SushiSwap, the movement of ETH’s USD price doesn’t usually affect the ETH valuation of your position much because LINK moves accordingly as well (usually). However, the USD valuation of your position will tend to fluctuate a lot, especially if ETH is jumping up and down throughout the day; when the price of ETH goes up, so will the USD value of your position, and vice versa. Such positions are far less likely to reach the liquidation debt ratio because of their ETH value stability compared to positions in stablecoin pools, and as such are far more welcoming to higher leverage.

To sum up the two rules: you open a stablecoin position if you want to increase the USD value of your principal; you open a two-volatile-assets position when you want the amount of assets you own to increase, regardless of their price.

How Much Leverage?

In most cases, the optimal leverage will be 2x. The APY number can be misleading because it grows a lot as leverage grows, but don’t forget that anything above 2x leverage makes your stake of the position less than 50%. A leverage of 2x makes it exactly 50%, meaning price increases in ETH will affect both sides of your position (the debt and the principal) equally.

However, 2.5x makes the debt of your position 60%, your principal dropping to 40%. In this case, an increase in the price of ETH will disproportionately affect your position, negating the increase in APY you get from the additional 0.5x leverage. Effectively, a leverage higher than 2x is a bet against the price of ETH — if it goes down, you make more profits, but if it goes up you are in trouble.

The only situation in which leverage higher than 2x is optimal is when the two assets in the pool move the same way, i.e., ETH grows by 10% and the other asset grows by 10%. In cases like that, it is economically sound to leverage a position to the max.

Example

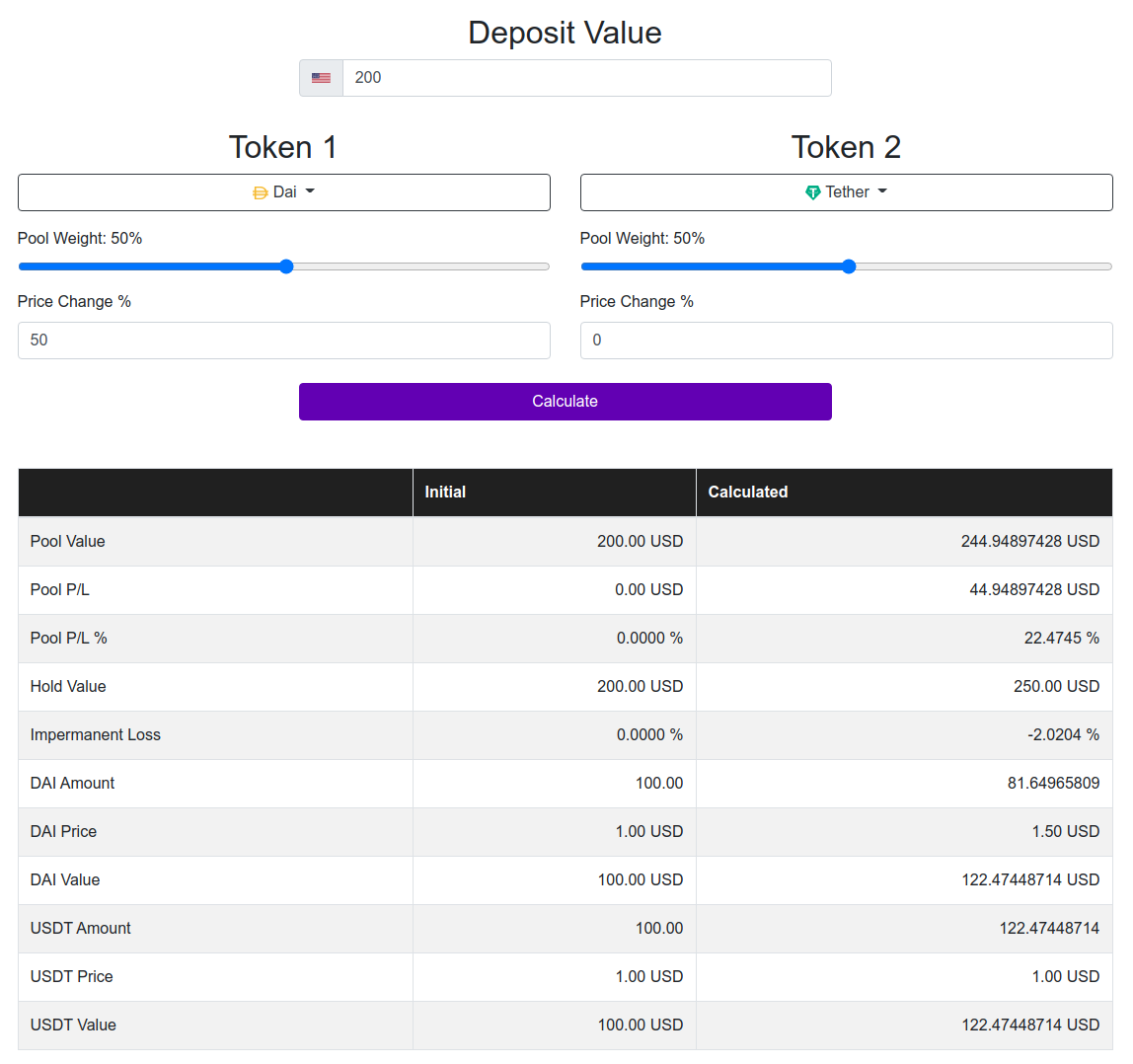

Let’s use the DAI/ETH pool on SushiSwap; and let’s say that you have 100 ETH, and that ETH’s price is $1. What you do at this point is open an impermanent loss calculator to establish different scenarios for different levels of leverage, e.g., if the price of ETH reaches $3 I’m in trouble. Let’s say that we choose a 2x leverage (0.5 below the max):

Your leveraged position value is $200 — 2x leverage of 100 ETH at $1 a piece. For the assets select two stablecoins, e.g., DAI and Tether. For one of the stablecoins, enter a percentage increase (or drop) and click Calculate. Take the new Pool Value ($244.94) and divide that by $1.5 (the new value of the volatile asset, a 50% increase) — we get 163.29 (the new value of your position in ETH). You can then calculate your new debt ratio — 100/163.29 = 0.61, i.e., 61%, an 11% increase from your starting 50% (100/200). Still, this is far from the liquidation debt ratio for the pool — 80%. Thus, you can establish that if ETH’s price increases by 50%, your position will be alive and well. Just for comparison, if you try the same scenario for 2.5x leverage, you will see that you will be at 73% debt ratio, only 7% away from liquidation.

You do the same thing for various scenarios and different pools. Once you are comfortable with a level of leverage and a pool, and you have a good idea of the possible scenarios, you can move on.

Note: the scenarios you establish from the impermanent loss calculator will not be 100% accurate because the calculator doesn’t take into consideration trading fees, but they will still give you a good idea of where your position will be given different price changes.

In the end, choosing which pool to leverage on Alpha Homora is the result of balancing between risk and profit, and your sense for the direction of the market.

Installing & Setting up MetaMask

In order to interact with the Alpha Homora app, you need to install and set up the MetaMask browser extension. Follow this guide to learn how to do that, and to also learn your way around the plugin.

Buying Cryptocurrency

If you don’t already have crypto assets at hand, you will have to purchase some. For Alpha Homora you will need nothing but ETH, but make sure to purchase some extra to pay for transaction fees. The platforms for purchasing cryptocurrency that we recommend are the following:

Choose the best option depending on your physical location and payment preference; follow this guide to learn how to purchase cryptocurrency on any of these platforms. Once you acquire the needed assets, send them to your MetaMask.

Opening a Leveraged Position

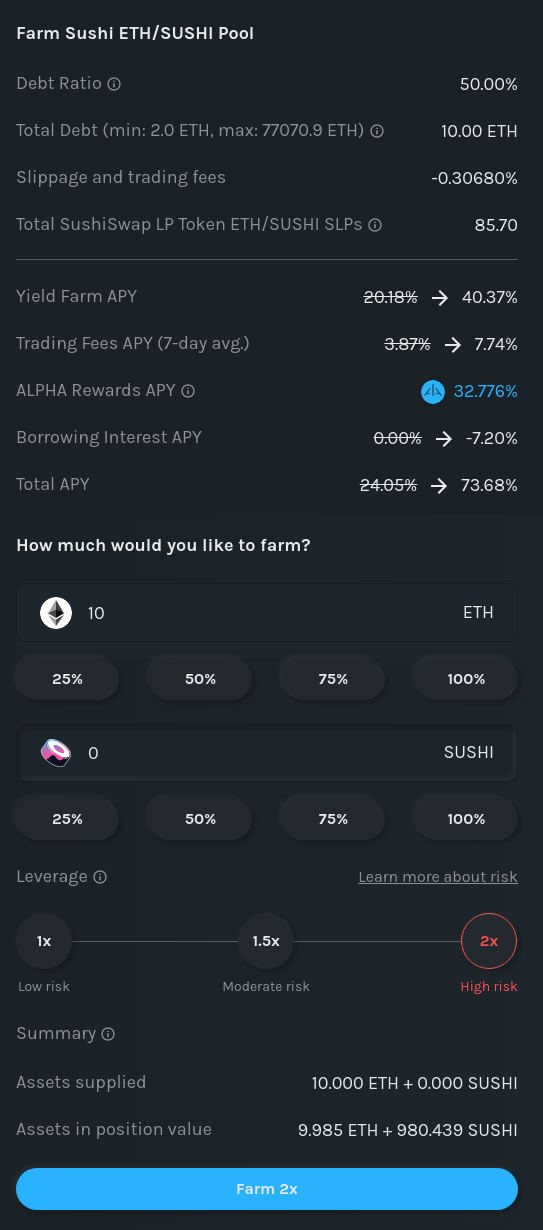

At this point, you should have chosen a pool to leverage and you should also have the assets ready in MetaMask. Open Alpha Homora V1 and click the Farm button for the pool you have chosen:

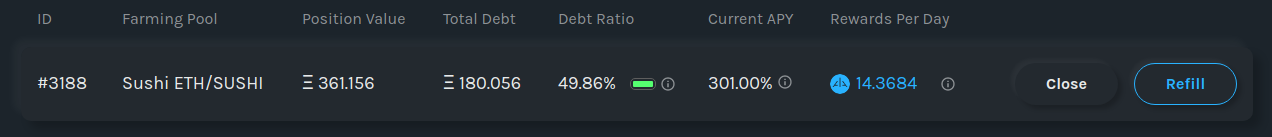

Check the Debt Ratio to make sure that the position is not too risky; review the rest of the numbers to confirm that everything looks right and click the Farm button. Confirm the transaction on MetaMask and wait for it to be included in a block. Once it is, you will be able to see your position:

And that’s all there is to opening a leveraged yield farming position on Alpha Homora.

Managing Leveraged Positions

Once you have active positions, your only task is to make sure that they don’t get liquidated; this means constant checks of the debt ratio and the volatility of each position’s underlying assets. If, for whatever reason, a position gets close to liquidation, you should either close it yourself if you think liquidation is inevitable, or you should add more assets to the position to lower the debt ratio.

Don’t be too eager to check the value of your position all the time. In the beginning, it will take some time to notice the profits due to asset volatility. If you are hell-bent on knowing your exact gains, mark the USD or ETH value of your position at a specific time of the day, and mark ETH’s price at that point as well. Then check the progress the next day.

How to Use Alpha Homora on Binance Smart Chain

To interact with the app on BSC you need to set up the network on MetaMask (follow this guide). Once you have done that you can open the BSC version of Alpha Homora and interact with it the same way you do with the Ethereum network.

Additional Ways You Can Earn on Alpha Homora

We already explained the main way you can earn on the platform — leveraged yield farming. However, you can also earn by lending assets, providing liquidity on Uniswap or SushiSwap for ALPHA token pairs, and you can also track debt positions and liquidate them when they reach a critical threshold.

Lending Assets

Since Alpha Homora supports both Ethereum and Binance Smart Chain, you have two options for lending on V1 — ETH and BNB. On V2, you can also lend DAI, USDT, and USDC.

Lending on V1

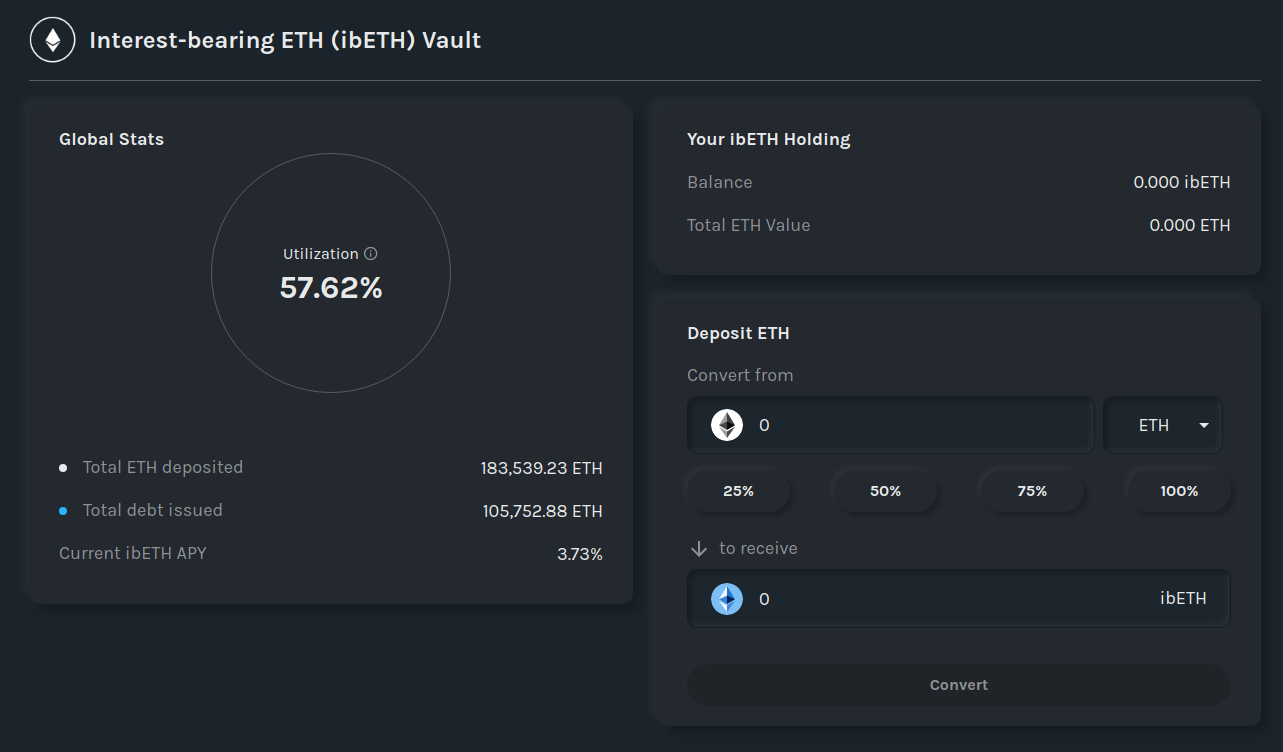

To lend ETH on Alpha Homora V1 go to the Earn on ETH page:

Enter the amount of ETH you want to deposit. You will see how much ibETH (interest-bearing ETH) you will receive in return. You can also see the current APY for depositors. Click Convert and confirm the transaction.

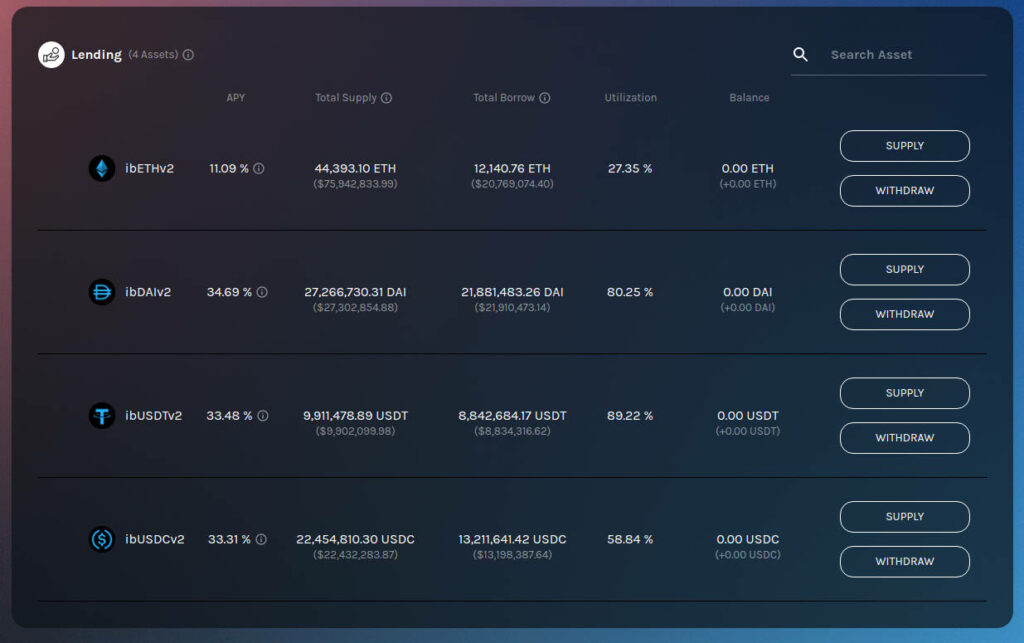

Lending on V2

As mentioned, aside from ETH, you can also lend DAI, USDT, and USDC on Alpha Homora V2. You can do so on the Earn page:

Click the Supply button for your chosen asset, enter an amount, and confirm the transaction on MetaMask. Lending APYs on V2 are much higher than V1 because V2 also includes rewards in the form of ALPHA tokens.

Reinvesting Rewards

You can reinvest earnings by positions for a 3% bounty. Alpha Homora V1 sells all earned yield — for example SUSHI tokens — and distributes the earnings appropriately to all leveraged positions. The reinvestment happens manually from the Status page:

The time for reinvesting a position is a matter of subtracting the transaction fee from the 3% reward, which you can see when you click Reinvest:

For example, from the screenshot above, I know that my reward will be around $70. If the transaction fee is less than that I can execute it and bag the profit.

Note: there are bots running that do this automatically when they determine that it is economically viable, so don’t be surprised when someone beats you to it every time.

Reinvesting earnings is available only on V1 — V2 doesn’t automatically reinvest earned tokens from yield farming, but rather, lets users do with them as they please.

Liquidating Debts

When a leveraged position reaches the liquidation debt ratio, it becomes available for, well, liquidation. That is where liquidators come in. They track positions and liquidate them when they are given the chance. For their time, they receive a 5% bounty from the collateral. Anyone can be a liquidator.

Debt Liquidation on V1

To track positions in danger of liquidation, open the Status page and scroll down the the Explore All Positions section:

The unlucky souls who own these positions will be hoping that the Liquidate button never becomes available. However, if it does, you can liquidate the position and receive 5% of the collateral. Keep in mind that many people (and bots) race to liquidate positions and it’s not easy to be first.

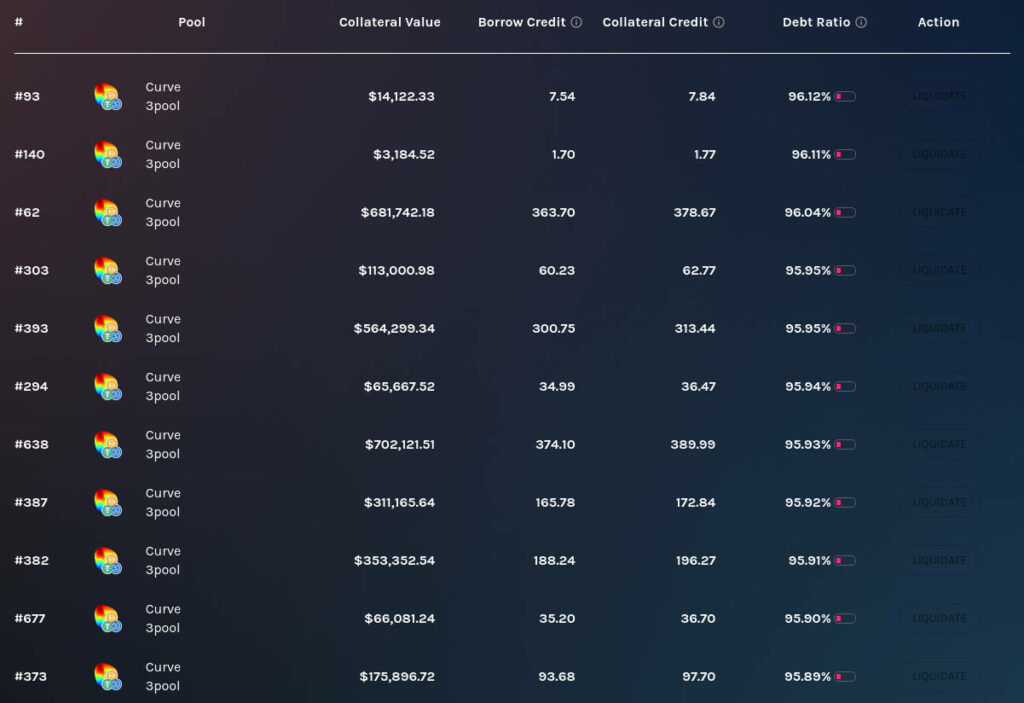

Debt Liquidation on V2

To liquidate positions on V2 go to the All Positions page:

The process is the same as with V1 — follow the page and when a position reaches a debt ratio of 100%, liquidate it and receive the bounty.

ALPHA Pools

On V1 you can provide liquidity for the ETH/ALPHA and ibETH/ALPHA pools on Uniswap to earn from trading fees, while on V2 you can provide liquidity for the same pools on SushiSwap to earn trading fees plus SUSHI rewards. These pools are useful for lenders on the platform who also hold ALPHA tokens in expectation of its price going up. Instead of holding their assets statically, they can join the pools to farm even more rewards.

Summary

Alpha Homora allows liquidity providers to leverage their yield farming positions and earn more profits on DeFi platforms such as Uniswap, SushiSwap, and Pancake Swap. The app currently supports two versions — V1 and V2 — with leveraging available only on V1. V1 also supports Binance Smart Chain in addition to Ethereum.

The leveraging process is seamless, but requires a good understanding of impermanent loss, AMM-based protocols, management of leverage, and the Alpha Homora platform itself. Leveraged positions are risky, but can be very profitable if done right.

- Decentralized finance (DeFi) has become one of the hottest trends in the crypto world as it’s more transparent and decentralized than traditional finance.

- Here are our top picks of DeFi projects that have a good potential growth, and some of the protocols that did not made the list, such as RING Financial.

- 2022 is on the verge of becoming the largest year for crypto crime ever, with close to $3 billion being stolen so far.

- The majority of the hackers focused on cross-chain bridges and decentralized finance apps.

- Passwords have become a part of our daily life, protecting our most sensitive data, and we have to make sure they are as secure as possible.

- There are many ways a password can become compromised, as such it remains important that we become aware of some of the most common password myths.