How to Farm BNT on Bancor – The Simple Guide

- Bancor’s liquidity mining program offers lucrative APYs, impermanent loss protection, and single-sided exposure.

- We explain how Bancor works, how its liquidity mining program works, and how to farm BNT rewards on the platform.

Shutterstock

Table of Contents

Bancor was the first decentralized exchange to successfully employ an automated market maker protocol, giving rise to the era of the DEX. The platform was enabled by the BNT — a token with many functions, one of the latest being liquidity mining. Liquidity providers in approved pools by community vote receive weekly BNT rewards for their efforts, with APYs as high as 120%. Though 100% APY is nothing to brag about in DeFi, Bancor has an edge since V2.1 — impermanent loss protection; the platform allows for single-sided exposure in liquidity pools, eliminating the IL problem inherent in AMM-based exchanges.

What You’ll Learn

- How Bancor works

- How Bancor’s liquidity mining program works

- How Bancor’s impermanent loss protection works

- How the Bonus Reward Multiplier (BRM) works

- How to join a Bancor liquidity pool and farm BNT

- How to track BNT rewards and when it is optimal to withdraw

- How to stake BNT rewards to earn even more BNT

How Bancor Works

Bancor works like any other AMM-based exchange: couples of assets are bundled into liquidity pools which people can use to exchange one cryptocurrency to another. In Bancor’s case, however, most pools use BNT as the counterpart asset. This allowed the platform to come up with an innovative solution to the impermanent loss problem.

How Bancor’s Liquidity Mining Program Works

The program was launched in November 2020 and became an instant hit. It works like any other yield farming program — liquidity providers stake liquidity in pools and earn rewards (in BNT) as long as they stay put.

The program can be applied to any pool through a proposal. For example, the USDC/BNT pool currently receives 100,000 BNT rewards per week.

How Bancor’s Impermanent Loss Protection Works

Let’s take the USDC/BNT pool as an example. I have 100 USDC and I decide to invest it into the pool to farm BNT. Thanks to the single-sided exposure feature, I don’t need to exchange 50 of my USDC for BNT in order to join the pool:

- I join the pool with my 100 USDC.

- Bancor mints 100 BNT from its DAO and stakes it as a counterpart to my 100 USDC (1 BNT = 1 USDC in this example).

- After three months of farming BNT, I decide to exit the pool.

- The price of BNT decreased by 10% in this period. Without impermanent loss protection my stake would have dropped to 90 USDC.

- I withdraw 105 USDC — my 100 plus 5 from trading fees.

- The 100 BNT that Bancor staked to cover my position is now 115 (10 from the drop in price of BNT and 5 from fees).

- Just enough of the 115 BNT is sold to cover for my impermanent loss, with the rest burned.

The impermanent loss protection is active only on whitelisted pools, i.e., pools that support single-sided exposure. It takes 100 days for a position to be fully protected (1% protection per day), and there is a 30-day cliff. This means that your position is not protected at all for the first 30 days, even though you see a quotidian growth of 1%. On the 31st day your position will instantly have 30% coverage. After another 70 days, you will be at 100%.

How Bancor’s Bonus Reward Multiplier (BRM) Works

The BRM is a feature designed to prevent liquidity providers from dumping their BNT rewards. It works like this:

- I stake 100 USDC in the USDC/BNT pool.

- For my stake, I get 100 BNT per week as a reward.

- The BRM is set to 1x when I open my first position in a pool.

- After 7 days, I have 100 BNT in rewards.

- On the first block of the 8th day, the reward becomes 125 BNT (BRM is now 1.25x).

- Another 7 days pass and my BNT rewards are now 225 BNT.

- On the first block of the 15th day, my rewards become 300 BNT (BRM is now 1.5x). We get to 300 like this: My rewards without BRM are 200 BNT. This is multiplied by the new BRM (1.5x). My previous BRM reward (25 BNT) is then subtracted from the new BRM reward, i.e., 100 – 25 = 75. The result is added to my overall BNT rewards.

- Another 7 days pass and I now have 400 BNT (300 without the BRM).

- On the first block of the 22nd day, my rewards become 525 BNT (BRM is now 1.75x).

- Another 7 days pass and I now have 625 BNT (400 without BRM).

- On the first block of the 29th day, my rewards become 800 BNT (BRM is now at its maximum 2x).

Because of the way the BRM is designed it is not optimal to withdraw BNT rewards before 2x is reached at the end of the fourth week since withdrawing resets the BRM to 1x; the reset applies to all of your positions in pools on Bancor. Re-staking your rewards, however, doesn’t reset the BRM. All the APYs you see on the Data page are based on a 2x BRM.

The BRM is pool-based, i.e., if you have 2x BRM in the USDC/BNT pool and you open a new position in the ETH/BNT pool, the BRM on it will be 1x. However, if you open a new position in a pool you already have a position in, the BRM on the new position is set to whatever it is for the oldest position in the pool, e.g., if you have a 100 USDC position at 2x BRM, and you add another 100 USDC to the pool, the second position’s BRM will be 2x off the bat.

How to Farm BNT on Bancor

It takes four steps to farm BNT on Bancor:

- Choosing a liquidity pool

- Buying cryptocurrency

- Setting up MetaMask

- Staking your assets

Choosing a Liquidity Pool

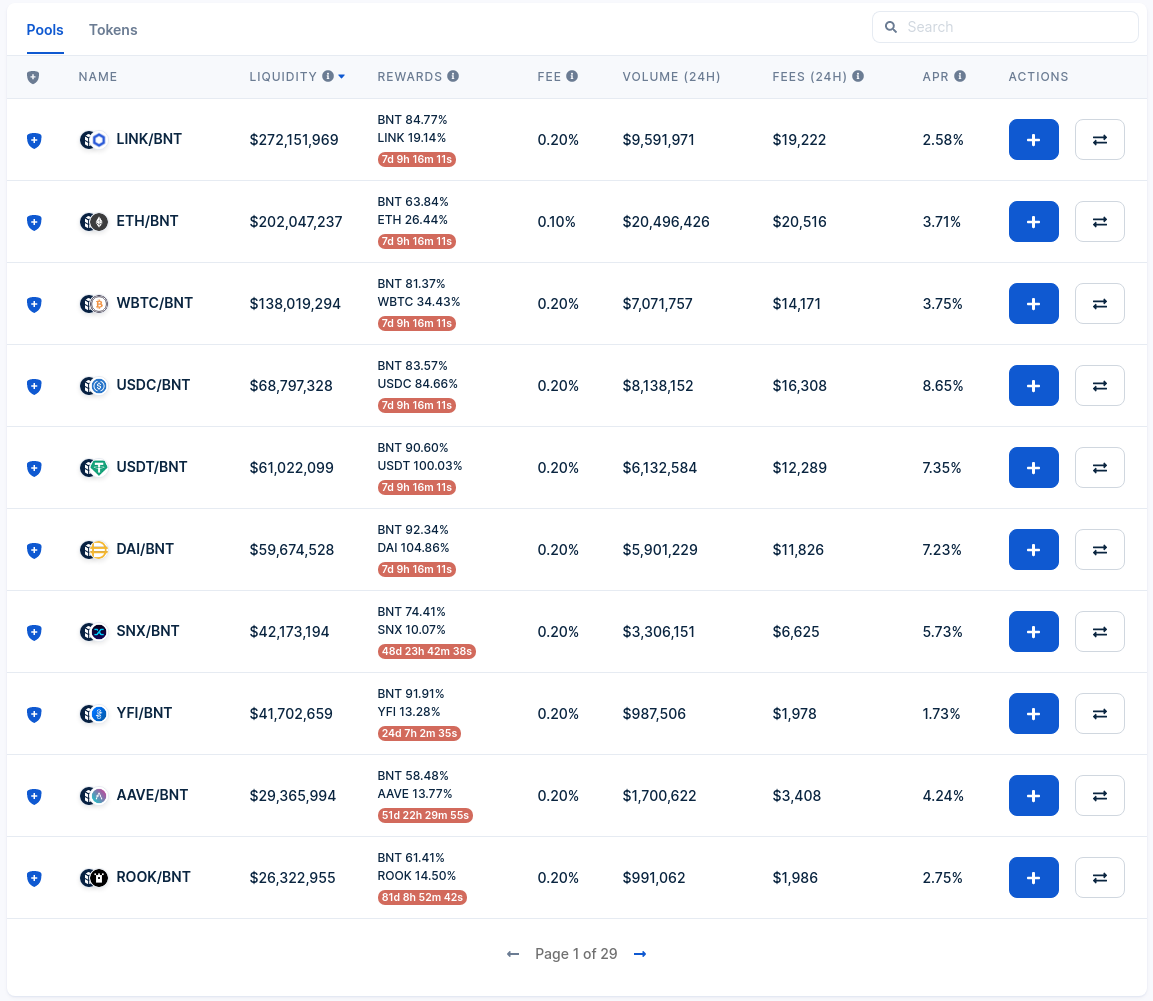

Head over to the Bancor Data page and scan the pools.

I don’t really know you so you will have to choose a pool on your own. What I would suggest is not rushing it, but rather, carefully analyzing your financial situation and the assets in the pools you are interested in. You should also join the Discord and ask questions you need answered. Reading through the FAQ is also very helpful in getting up to speed with the platform.

Buying Cryptocurrency

If you don’t already have crypto assets at hand, you will have to purchase some. Make sure to purchase extra ETH to pay for transaction fees. The platforms for purchasing cryptocurrency that we recommend are the following:

Choose the best option depending on your physical location and payment preference; follow this guide to learn how to purchase cryptocurrency on any of these platforms. Once you acquire the needed assets, send them to your MetaMask.

Setting up MetaMask

Follow this guide to set up MetaMask and learn your way around the extension. You need MetaMask to interact with Bancor.

Joining a Liquidity Pool

Let’s use the USDC/BNT pool as an example. From the Data page, click on the plus button for the pool:

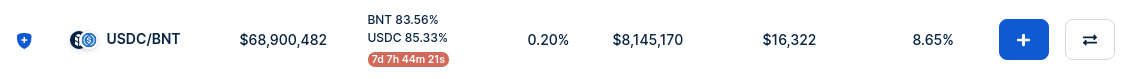

At the time of writing, staking USDC in the pool yields 85.33% per year; BNT, a close 83.56%. An additional 8.65% is yielded from trading fees. Let’s say that we will be staking USDC.

Click on the BNT dropdown to select USDC:

There’s a slot of about 7,000 USDC available. The availability is determined by the amount of BNT staked in the pool by liquidity providers. As we explained, Bancor co-stakes BNT when a new single-sided position is opened, but each pool has a limit on the amount of BNT that can be co-staked. In order for space to become available, someone needs to stake BNT, burning some of the co-staked BNT by the DAO.

To continue where we left off. Enter the amount you want to stake and click Stake and Protect. Click Confirm. An approval transaction will be generated first, followed by the staking transaction. Transaction fees on Bancor tend to be on the expensive side compared to other decentralized exchanges, however, you only need to send two transactions to start yield farming (approval and staking) compared to the standard three transactions on Uniswap and SushiSwap.

Once the staking transaction is approved, go to the Portfolio page to see your position(s) and watch the rewards mount.

There is no indicator of your current Bonus Reward Multiplier, so you will have to track that on your own. Using the impermanent loss coverage counter is one way to go about it. I have asked on Discord and a Bancor developer told me that they are working on adding a BRM indicator.

Managing Your BNT Rewards

As your rewards mount, it might become tempting to withdraw and liquidate. However, you have another option: re-staking the rewards to earn even more rewards. The scheme goes like this:

- I stake 100 USDC and start earning 100 BNT per week.

- After 4 weeks, I have 800 BNT (BRM is at 2x).

- Instead of withdrawing I decide to re-stake my 800 BNT in the LINK/BNT pool, which will earn me 83% APY plus 3% in trading fees.

- I receive 800 vBNT for staking my BNT — vBNT is awarded whenever a liquidity provider stakes BNT in a pool. The token is used for voting in proposals and to farm on margin via Bancor Vortex.

- I then stake the 800 vBNT in the vBNT/BNT pool for 90% APY.

- I have just turned my 800 BNT reward into another investment position, with almost 200% APY.

To re-stake your BNT rewards, go to the Portfolio page and click the Stake button in the Rewards section and choose a pool:

Enter the amount of BNT you want to stake and click Stake and Protect. Finally, confirm the approval and staking transactions on MetaMask. If you wish, you can then stake the vBNT as well (if there’s space available). However, there is risk involved with staking your vBNT.

Using Bancor Vortex to Farm on Leverage

Vortex allows liquidity providers on Bancor to yield farm on leverage. It works as follows:

- I stake 100 BNT in any pool to farm BNT rewards.

- I receive 100 vBNT in return; the vBNT represents my stake in the pool, and I need it to withdraw my stake.

- I can sell the vBNT on Bancor for any other asset I want, say, ETH, and stake that ETH to earn even more BNT rewards.

In the end, I will still need 100 vBNT to withdraw the initial 100 BNT that I staked. Essentially, the cost of leverage comes down to the difference between the valuation of the assets I obtained from selling the vBNT plus the rewards I gained from staking those assets minus the cost to re-purchase 100 vBNT to withdraw my stake. Example:

- I sell 100 vBNT for 1 ETH (1 vBNT = $1, 1 ETH = $100).

- I stake the ETH and earn 60 BNT rewards in the next 4 weeks.

- The price of vBNT rises to $2, but the price of BNT also rises to $2. ETH stays the same at $100.

- I liquidate my ETH position and obtain 1 ETH and 60 BNT.

- I exchange the 1 ETH for 50 vBNT and 50 BNT for another 50 vBNT.

- I now have 100 vBNT again and I can withdraw my initial 100 BNT stake.

- I am left with 10 BNT profit from the entire trade.

Like any other leverage scheme, Bancor Vortex is risky. You shouldn’t use it unless you are understand how the prices of digital assets move in relation to one another, how vBNT works, and how a leveraged position should be managed.

Summary

Bancor offers a lucrative liquidity mining program and a straightforward staking and management process. Liquidity providers enjoy impermanent loss protection and single-sided exposure in pools. The BNT rewards system includes a rewards multiplier feature which discourages LPs from dumping too often, but encourages them to re-stake their rewards to earn even more and help grow Bancor. The exchange has its own borrowing feature — Bancor Vortex — allowing investors to yield farm on leverage. Bancor recently crossed $1 billion in total value locked and continues to grow in popularity, primarily because of its liquidity mining program.

- Decentralized finance (DeFi) has become one of the hottest trends in the crypto world as it’s more transparent and decentralized than traditional finance.

- Here are our top picks of DeFi projects that have a good potential growth, and some of the protocols that did not made the list, such as RING Financial.

- 2022 is on the verge of becoming the largest year for crypto crime ever, with close to $3 billion being stolen so far.

- The majority of the hackers focused on cross-chain bridges and decentralized finance apps.

- Passwords have become a part of our daily life, protecting our most sensitive data, and we have to make sure they are as secure as possible.

- There are many ways a password can become compromised, as such it remains important that we become aware of some of the most common password myths.