DeFi-Friendly Smart Wallet Startup Raises $12M

- Argent’s $12 million Series A funding round was led by the Sequoia Capital-backed fund Paradigm.

- Thanks to previous partnerships, the wallet allows its users to to purchase cryptocurrency with their debit cards and Apple Pay accounts.

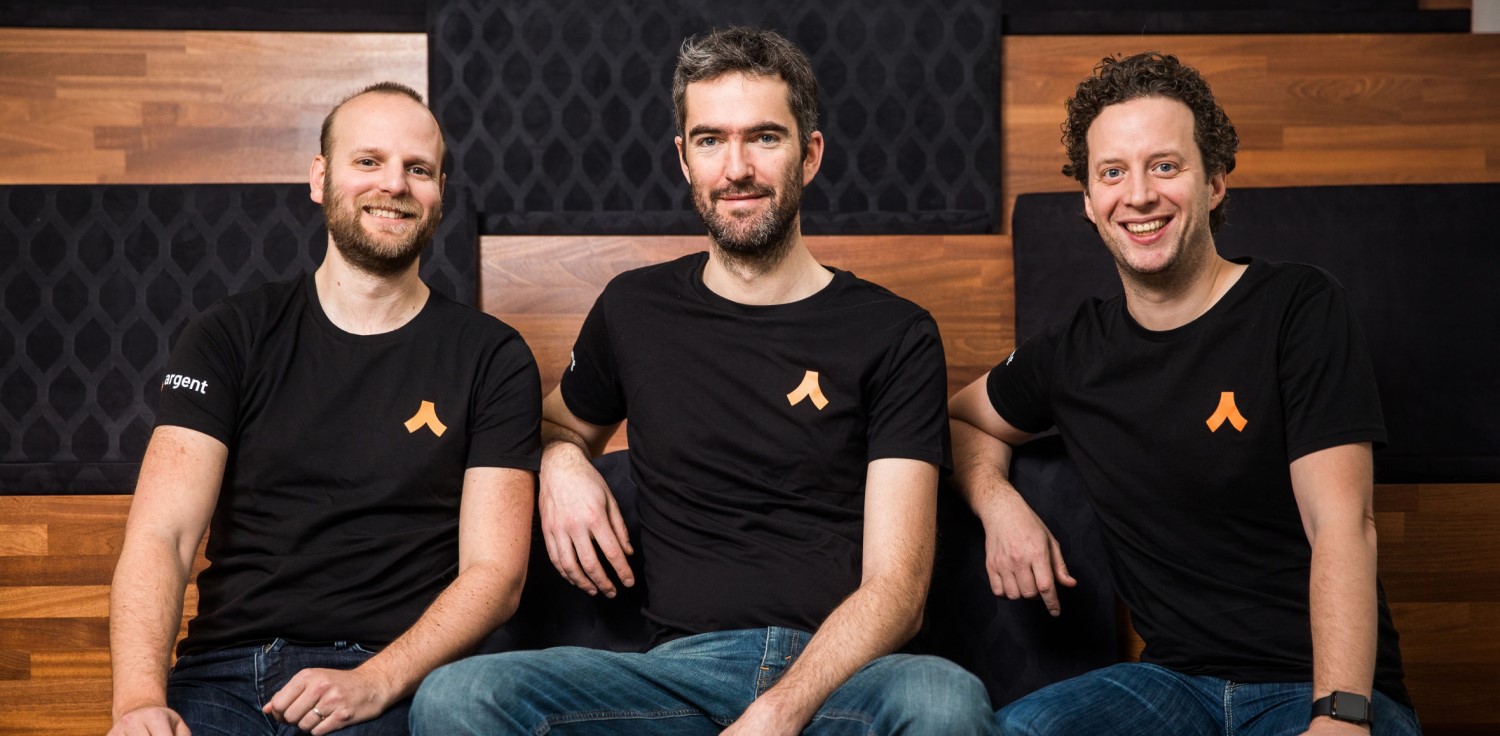

From left: Argent CTO Gerald Goldstein, CSO Julien Nisen, and CEO Itamar Lesuisse. Argent

London-based startup Argent raises fresh $12 million in a Series A funding round led by the Sequoia Capital-backed fund Paradigm, the firm said in a blog post on 9 March.

According to the announcement, the funding round was spearheaded by Coinbase’s co-founder Fred Ehrsam and ex-Sequoia partner Matt Huang, and also saw participation from the founder of Compound Robert Leshner and Index Ventures. The smart wallet startup has reportedly raised around $16 million since it was founded in December 2017.

The Argent wallet aims to not only address its users concerns over security and user control, but also provide the same simplistic design, that contender banking apps have been offering to their clients. With that in mind, the wallet has already simplified he access to dapps, removed seed phrases and gas, and introduced daily transfer limits and large transfer approval.

Designed for simplicity, the wallet allows its users to purchase cryptocurrency with their debit cards and Apple Pay accounts, thanks to partnerships between Argent, Wyre and MoonPay. Not only is a unique identifier associated with the user’s phone, but a back-up recovery method is also set up with either the users friends and family or Argent, which is unique in the industry. Itamar Lesuisse, the co-founder and CEO of Argent, said that security has alwayst been the firm’s “highest priority”, and that the company will continue to invest heavily in it. He also said:

“We’ll also soon remove the waitlist and have a full public launch. We’re excited about the chance to break down any remaining barriers to getting involved in crypto.”

In order to extend its usability for the decentralized finance market, Argent integrated with the MakerDAO protocol last year. The integration also simplified the users ability to open MakerDAO Collateralized Debt Positions, which are smart contracts that allow users to borrow Dai stablecoins using their Ethereum (ETH) as collateral.

- A little over $13 million in altcoins were sent to crypto exchanges Binance and Coinbase in the past 24 hours, which is in accordance with a September court order.

- The court ordered a phased liquidation process, which allows the bankruptcy estate to sell $3.4 billion worth of digital assets over a certain period of time.

- Coinbase’s Base blockchain was made available to the public on Wednesday, featuring over 100 dApps and services as part of its ecosystem.

- In order to show its capabilities and promote its mainnet partners, Base has also launched an event called “Onchain Summer” that will allow users to mint exclusive NFTs on the network.

- During an interview with FT, CEO Brian Armstrong said that before the lawsuit a SEC staff member had said that all crypto except BTC was security, and should be delisted.

- When asked how he came to that conclusion, the SEC staff member reportedly said “we’re not going to explain it to you, you need to delist every asset other that Bitcoin”.