DeFi Platform Vesper Grows 1,000% Following Mainnet Launch

- Since its official launch on 17 February, the platform’s native VSP token has increased in value from the original $2.50 to the current $33.50.

- Vesper’s core product, the “Grow Pools”, allow the platform to generate yield by deploying pooled liquidity to various DeFi protocols.

Image from Shutterstock

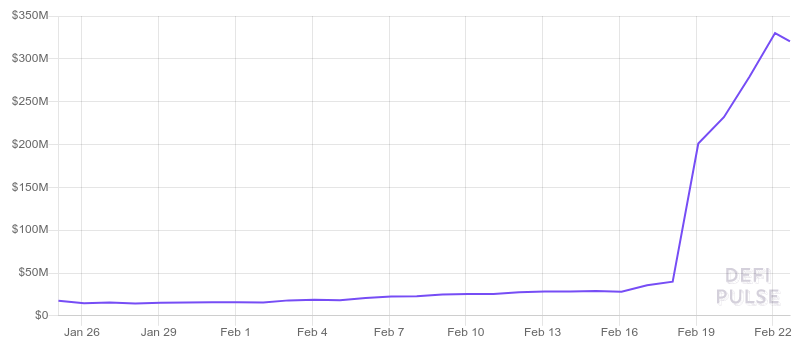

In mere days after it was officially launched, the Vesper “easy-to-use” platform saw an explosion of interest from the yield farmers. According to the firm’s Saturday blog post, it took the platform only 24 hours to surpass the $100 million trading volume mark, and two days to accumulate more than $240 million in TVL. In another day, it had gone over $300 million, more than 1,000% increase from the $28 million pre-launch.

With over 1,800 active depositors, the price of the platform’s VSP token has also seen a surge in price, climbing from its original valuation of $2.50 to the current $33.50.

Officially launched on 17 February, the aim of the platform is to provide investors with an alternative to the traditional way of investing in DeFi, and reduce the entry barrier for new users. The firm’s “Grow Pools” — Vesper’s core product — lets users stake their crypto on the platform, while leaving the due diligence and actual farming to Vesper. The pools are designed to generate yield by deploying pooled liquidity to other DeFi protocols, such as Aave and Compound. The team behind the project has said:

“Unlike other yield farming contracts, Vesper Grow Pools emphasize the deployment of deposited assets into third-party DeFi products that generate interest with the goal of growing those deposited assets. Funds in Vesper pools are used to borrow, lend, and farm yield across various DeFi projects. Users will select a pool that gives them the asset they want and fits their risk tolerance.”

While the team plans to add additional investment strategies, at launch Vesper only released three conservative-strategy pools, them being ETH, wBTC, and USDC. The pools will algorithmically update and apply modular strategies to continually improve their APY. The platform’s native VSP token — used for incentivizing participants and for the governance of the project — has also been officially released, and is already available for trade on SushiSwap, Uniswap, and 1inch.

The Grow Pools are not the only product Vesper plans to offer its customers. The firm is already working on its new “Earn Pools” — which the company calls “programmable yield” — that also allows users to passively generate yield off of their deposited assets. The difference is that it allows users to deposit one asset, earn yield on it, and use those proceeds to acquire a different asset.

- Decentralized finance (DeFi) has become one of the hottest trends in the crypto world as it’s more transparent and decentralized than traditional finance.

- Here are our top picks of DeFi projects that have a good potential growth, and some of the protocols that did not made the list, such as RING Financial.

- 2022 is on the verge of becoming the largest year for crypto crime ever, with close to $3 billion being stolen so far.

- The majority of the hackers focused on cross-chain bridges and decentralized finance apps.

- Investment opportunities in defi are innumerous, but finding the best hasn’t been an easy task thus far.

- Yield Samurai is a decentralized finance data aggregator that helps investors find the highest-yielding pools in a few clicks.